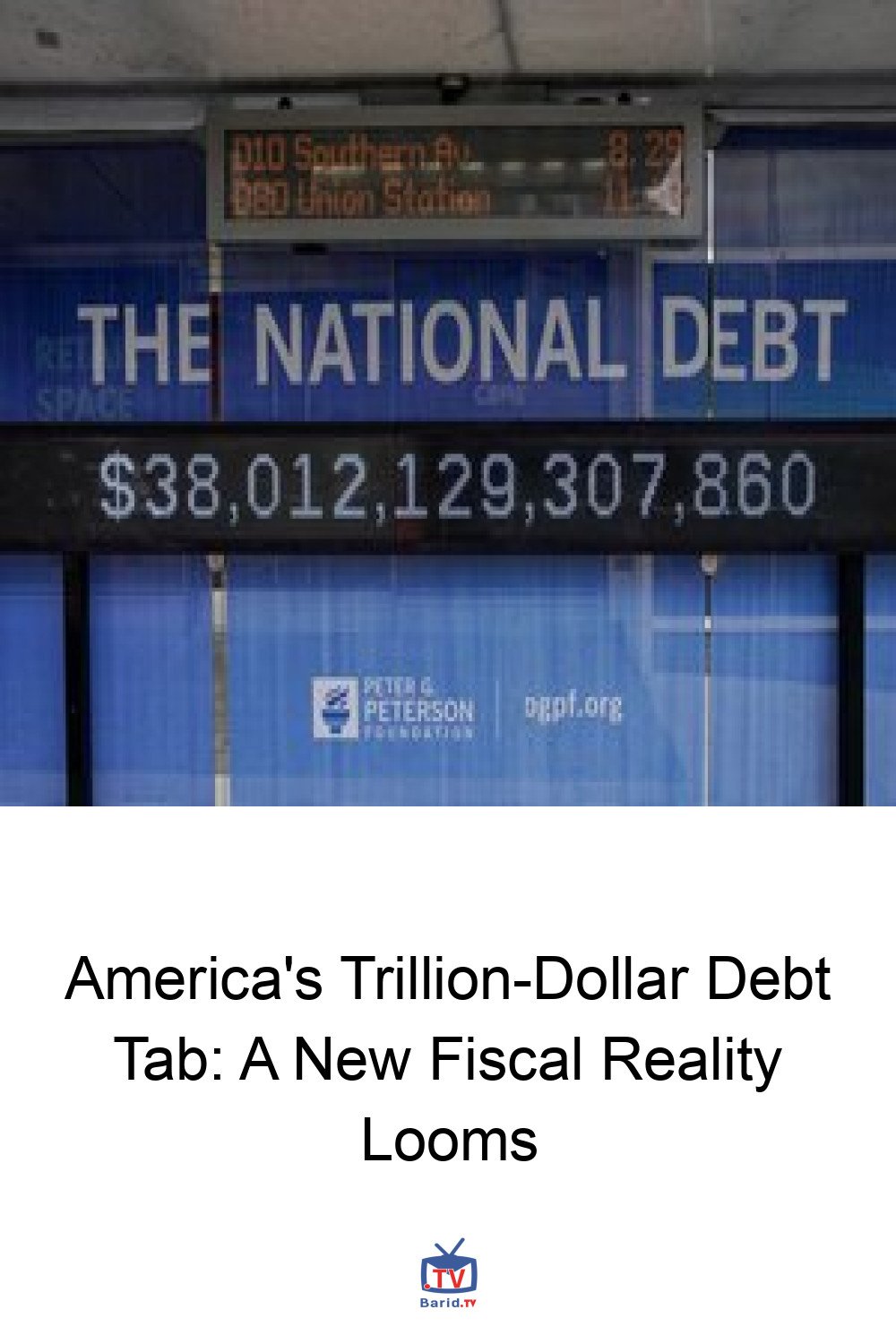

America’s Trillion-Dollar Debt Tab: A New Fiscal Reality Looms

The American economy, increasingly accustomed to astronomical figures, is bracing for yet another unprecedented milestone: the U.S. government is projected to incur a staggering $1 trillion in interest payments on its national debt this year. This remarkable threshold, once unthinkable, underscores a dramatic acceleration in the nation’s fiscal obligations, signaling a profound shift in its economic landscape.

A Staggering Surge in Interest Payments

The trajectory of these payments is particularly alarming. In 2020, at the onset of the COVID-19 pandemic, interest payments totaled $345 billion. Just six years later, that figure has nearly tripled, a development the nonpartisan Committee for a Responsible Federal Budget has ominously dubbed “the new norm.” With the U.S. now owing its lenders approximately $38.4 trillion, the cost of servicing this colossal debt is rapidly becoming one of the federal government’s most significant expenditures.

Political Rhetoric vs. Fiscal Reality

Despite regular bipartisan lip service paid to the imperative of shrinking the national debt, the reality on Capitol Hill often tells a different story. The appetite for uninterrupted borrowing was starkly demonstrated last summer with President Donald Trump’s “One Big Beautiful Bill,” a tax-and-spending behemoth carrying a $3.4 trillion price tag over a decade. Such legislative actions highlight a persistent disconnect between stated fiscal responsibility and actual policy implementation.

Navigating the Economic Waters

While this column is not a call for panic, it is an urgent invitation to take stock of the evolving economic realities. The U.S. dollar, though slightly diminished after a period of market volatility, retains its privileged position among global currencies. Investors are not fleeing en masse, and the nation’s ability to issue its own currency offers a degree of flexibility. Kent Smetters, a prominent economist at the Penn-Wharton Budget Model, projects that the U.S. economy’s breaking point, if current trends persist, is still a quarter-century away.

The Looming Trade-offs and Crisis Preparedness

However, the swelling national debt inevitably brings significant trade-offs. As Romina Boccia of the libertarian-leaning Cato Institute articulated in a recent House Budget Committee hearing, “Excessive peace-time deficits and debt also undermine America’s ability to borrow when it matters most, in times of crisis.” This suggests a future where the nation’s capacity to respond to unforeseen emergencies could be severely constrained by its existing financial burdens.

Global Repercussions: Who Benefits?

Intriguingly, the immediate beneficiaries of America’s escalating interest payments are investors in three key nations: Japan, China, and, somewhat surprisingly, the United Kingdom. With foreigners holding roughly one-third of all U.S. debt, a larger proportion of American income is now flowing overseas, a subtle yet significant shift in global wealth distribution.

A Glimmer of Bipartisan Shift?

Amidst this fiscal reckoning, a notable voice has emerged from an unexpected quarter. Mitt Romney, the 2012 Republican presidential nominee and former Utah senator, has publicly advocated for tax increases on the ultra-rich to address the burgeoning debt. This position, long anathema within the Republican Party, signals a striking evolution for Romney, who stated in a New York Times op-ed, “We have reached a point where any mix of solutions to our nation’s economic problems is going to involve having the wealthiest Americans contribute more.”

Romney’s shift, evident even in his skepticism towards down-sizing the IRS during his final Senate term, raises a critical question: will more policymakers, across the political spectrum, follow suit in re-evaluating long-held fiscal orthodoxies? For now, Tokyo, Beijing, and London can rest assured that their U.S. bond holdings are yielding increasingly lucrative returns, while Washington grapples with the implications of its trillion-dollar tab.

For more details, visit our website.

Source: Link