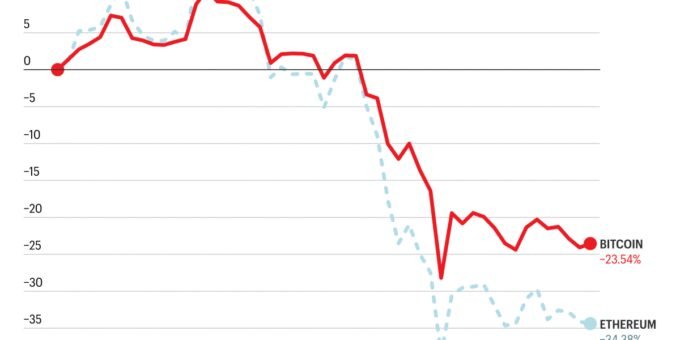

The phrase “Bitcoin to zero” is once again echoing through the digital ether, not as a prophecy, but as a stark indicator of market sentiment. Recent Google Trends data reveals a significant spike in these searches within the United States, coinciding with a notable dip in Bitcoin’s price. While historically such spikes have often preceded market rebounds, a deeper dive into the data suggests a more nuanced reality, particularly when comparing U.S. and global trends.

A Localized Surge of Fear in the U.S.

February 2026 saw U.S. Google searches for “bitcoin zero” hit an unprecedented peak, scoring a perfect 100 on the platform’s relative interest scale. This surge occurred as Bitcoin (BTC) slid towards the $60,000 mark, following a more than 50% drawdown from its October all-time high. For many, this dramatic increase in fear-driven searches could be interpreted as a classic sign of widespread capitulation – a moment when retail investors abandon hope, often preceding a market reversal.

Historical Precedent: A Contrarian Signal?

Indeed, past instances of similar U.S. search spikes in 2021 and 2022 have often coincided with local lows in Bitcoin’s price. This historical correlation has led some analysts to view the current trend as a potential contrarian buy signal, suggesting that the market might be nearing a bottom as panic reaches its zenith.

Global Sentiment Tells a Different Story

However, a closer examination of worldwide Google Trends data presents a contrasting narrative. Globally, interest in the term “bitcoin zero” actually peaked much earlier, in August, and has since seen a significant decline, falling to as low as 38 this month. Rather than setting new records, global fear searches have been on a downward trajectory for months.

U.S.-Specific Catalysts Driving Localized Panic

This stark divergence suggests that the current wave of panic is largely concentrated within the U.S. market rather than being a universal sentiment. This localized anxiety appears to align with recent U.S.-specific macroeconomic catalysts. Factors such as escalating tariffs, geopolitical tensions with Iran, and a broader “risk-off” rotation within domestic equities have dominated the macro narrative in recent weeks. It’s plausible that U.S. retail investors are reacting more acutely to these domestic headlines compared to their counterparts in Asia or Europe, where Bitcoin’s price movements are landing within a different news cycle.

The Nuance of Google Trends: Beyond Raw Numbers

Interpreting Google Trends data, while insightful, requires a careful understanding of its methodology. The platform doesn’t report raw search volume but scores interest on a relative 0-to-100 scale. A score of 100 simply indicates a term’s peak popularity within the selected time window, relative to its own historical performance.

A Growing User Base Changes the Baseline

Crucially, Bitcoin’s overall user base and mainstream visibility have expanded dramatically since 2021. Therefore, a “100” score in February 2026, while signaling elevated retail anxiety, doesn’t necessarily mean a greater absolute number of people are searching for “bitcoin zero” compared to a “100” score during the 2022 bear market. Instead, it signifies a peak relative to a significantly higher baseline of overall interest in Bitcoin. This methodological wrinkle complicates a direct comparison to previous market bottoms.

Mixed Signals for a Definitive Market Bottom

In conclusion, while the dramatic surge in “bitcoin zero” searches in the U.S. undeniably points to heightened retail fear and, historically, could foreshadow a local bottom, the global cooling trend and the inherent relativity of Google Trends data temper this signal. Retail fear is clearly elevated in the U.S., but the traditional “searches hit a bottom” framework may not carry the same weight when the global trend is cooling and the user base has expanded. It serves as a potent reminder of elevated anxiety, but perhaps not the unequivocal “bottom” indicator some might hope for, suggesting that investors should approach such signals with cautious optimism.

For more details, visit our website.

Source: Link

Leave a comment