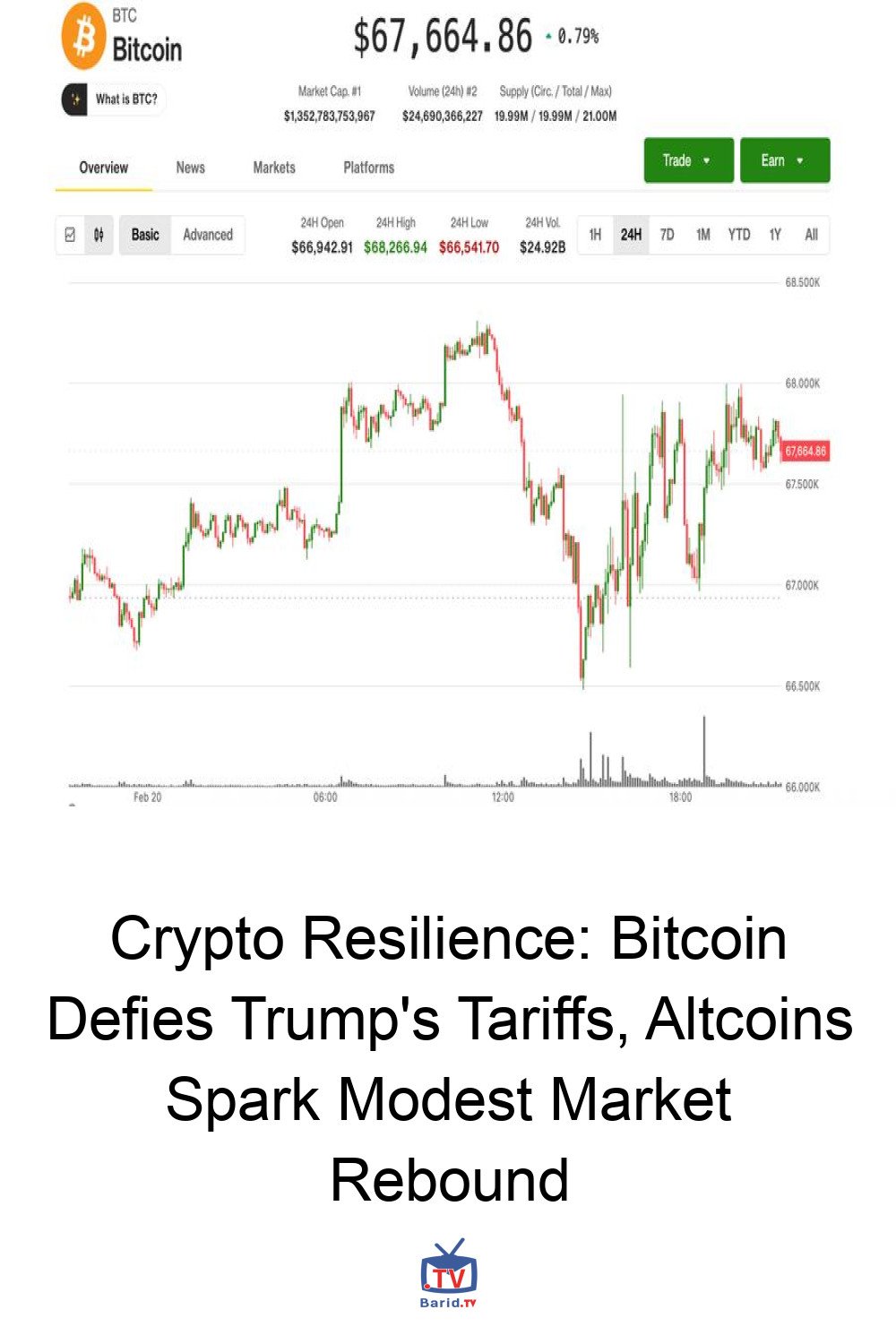

In a display of remarkable resilience, the cryptocurrency market shrugged off a fresh wave of economic uncertainty on Friday, as Bitcoin climbed towards the $68,000 mark and altcoins orchestrated a modest but notable bounce. This upward movement defied a turbulent day marked by a U.S. Supreme Court ruling on President Donald Trump’s tariffs and his subsequent announcement of new global levies.

Tariff Turmoil: A Day of Legal and Economic Swings

The day’s drama began with a significant pronouncement from the U.S. Supreme Court, which declared President Trump’s existing global tariff rollout illegal. While the ruling left open questions regarding the fate of already collected tariff revenue and didn’t necessarily signal the end of Trump’s broader trade agenda, it introduced a layer of legal complexity.

However, the market’s brief respite was short-lived. By Friday afternoon, President Trump unveiled plans for an additional 10% global tariff, to be implemented under Section 122 and effective within three days for approximately five months. This new levy, layered on top of existing duties, might have been expected to dampen investor sentiment significantly. Yet, the crypto market, alongside broader risk assets, demonstrated an unexpected fortitude.

Bitcoin Holds Strong, Altcoins Lead the Charge

Despite the tariff headwinds, Bitcoin (BTC) brushed aside the volatility, inching closer to the psychologically important $68,000 threshold. The broader market, as reflected by the CoinDesk 20 Index, registered a healthy 2.5% gain over the past 24 hours. Leading this modest rally were several prominent altcoins, with BNB, Dogecoin (DOGE), Cardano (ADA), and Solana (SOL) each posting impressive advances of 3%-4%.

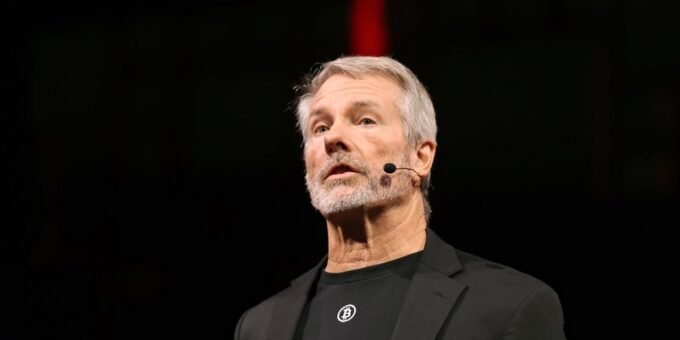

Traditional markets also saw positive movement, with the S&P 500 and Nasdaq 100 climbing 0.9% and 0.7% respectively. Crypto-linked equities mirrored this trend, as Coinbase (COIN), stablecoin issuer Circle (CRCL), and Bitcoin treasury firm MicroStrategy (MSTR) all saw gains exceeding 2%. Interestingly, Bitcoin miners with ties to AI infrastructure, such as Riot Platforms (RIOT), Cipher Mining (CIFR), IREN, and TeraWulf (WULF), experienced a downturn, falling between 3% and 6%.

Expert Outlook: Range-Bound Trading Amidst Geopolitical Shadows

While the market’s immediate reaction to the tariff news was positive, experts caution against overly optimistic expectations for a sustained breakout. Paul Howard, a director at trading firm Wincent, noted, “We have seen a small rally for risk assets post-tariffs news as it leads into a narrative that tariffs are damaging for the macro environment.”

However, Howard emphasized that conviction for a significant upside move remains light. “Volumes, however, remain muted and we can expect crypto to maintain range bound trading for the time being,” he added, stipulating this outlook holds true “barring any macro or geopolitical shocks coming.”

One such potential macro risk looms large: the possibility of President Trump ordering strikes against Iran in the coming days, following weeks of significant military buildup in the region. Such an event could swiftly alter the current market dynamics and introduce a new layer of uncertainty for risk assets globally.

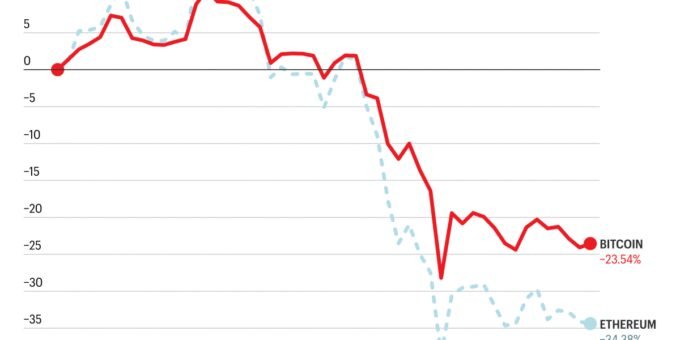

Retail Interest vs. Whale Activity

Further analysis of market dynamics reveals a fascinating divergence in investor behavior. Smaller investors have been actively accumulating Bitcoin, with wallets holding less than 0.1 BTC increasing their share of supply to levels not seen since mid-2024. This contrasts with larger holders – the “whales and sharks” with 10 to 10,000 bitcoins – who have reportedly trimmed their positions since the October peak. This divergence suggests that while retail enthusiasm is present, the lack of significant accumulation from larger players could contribute to choppy and fragile price action, making sustained rallies challenging without broader institutional support.

For more details, visit our website.

Source: Link

Leave a comment