A Chilling Start: Bitcoin and Ethereum’s Historic Slump

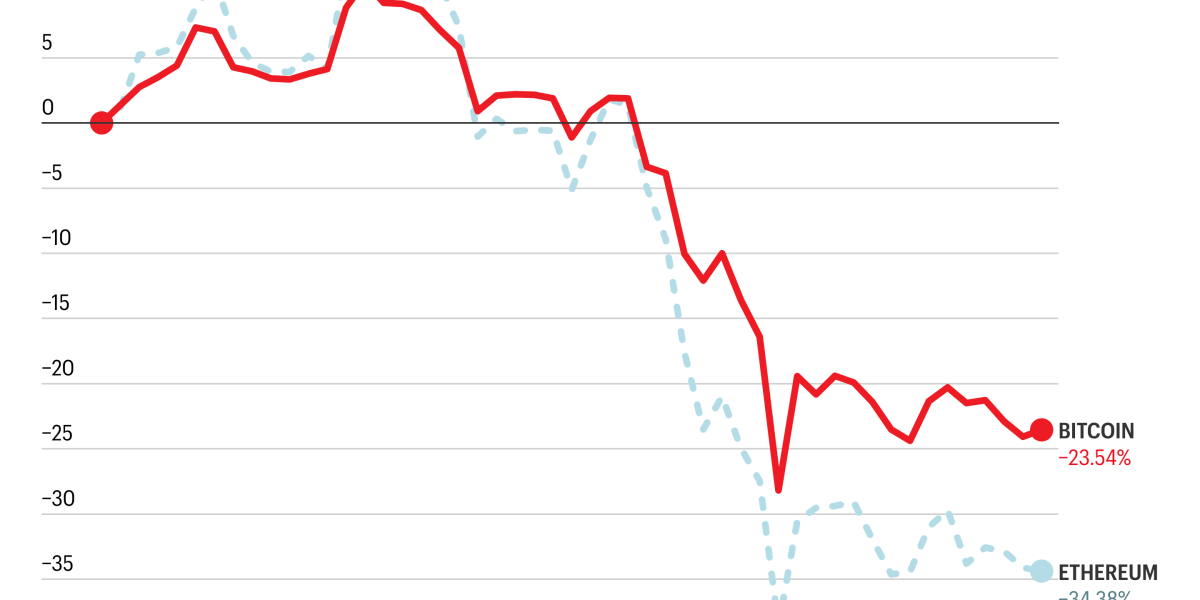

The digital asset landscape is currently navigating turbulent waters, with the world’s two largest cryptocurrencies, Bitcoin and Ethereum, enduring their most challenging start to a year in over a decade. Despite a flicker of modest gains on Friday, the overall picture remains stark. Bitcoin has plummeted nearly 24% since January 1st, settling around the $67,000 mark, while Ethereum has suffered an even steeper decline of approximately 34%, hovering near $2,000. This represents the worst year-to-date performance on record for both assets, according to an analysis of CoinGecko’s extensive public data, which tracks Bitcoin since mid-2013 and Ethereum since mid-2014.

A Market Apart: Crypto’s Divergence from Traditional Assets

Historically, the ebb and flow of cryptocurrency prices have often mirrored the broader equities market. However, the past two months have witnessed a significant divergence. While the crypto market has struggled, traditional stock markets have nudged upward, with the S&P 500 gaining about 0.4% and the Dow Jones rising 2.3% since January. Even precious metals, which experienced a sudden dip recently, are now thriving; gold has rocketed approximately 17% and silver jumped about 14% to kick off the new year. This stark contrast has led many to declare the onset of a new “Crypto Winter,” a term that resonates despite Bitcoin having reached all-time highs just four months prior.

“We’re certainly in a Crypto Winter,” affirms Danny Nelson, a research analyst at the crypto asset manager Bitwise. “You can tell by how investors react to good news. (They don’t.)”

Echoes of a “Flash Crash” and Lingering Losses

The year-to-date plummets in Bitcoin and Ethereum’s valuations follow a significant “flash crash” on October 10th. This event saw over $19 billion in leverage evaporate from the market after President Donald Trump issued a new round of tariff threats against China. The one-day implosion marked the worst liquidation event ever recorded by the crypto analytics firm Coinglass, leaving a lasting impact.

Since early October, Bitcoin has fallen more than 46%. The ripple effects have been felt across the industry, with major crypto exchanges like Coinbase and Gemini reporting disappointing fourth-quarter results. The downturn has also left many traders deep in the red. BlockFills, a crypto lender and hedge fund, notably suspended customer withdrawals in early February and is now reportedly seeking a buyer, grappling with losses exceeding $75 million, according to CoinDesk. A spokesperson for BlockFills declined to comment on the matter.

The Puzzling Catalyst: A Winter Without a Clear Storm

What makes this current decline particularly perplexing for many in the crypto community is the absence of an obvious, explicit catalyst. Previous bear markets, such as the dramatic collapse of FTX in November 2022, were triggered by clear, identifiable events. This time, however, the industry finds itself in a downturn even as it enjoys unprecedented acceptance among U.S. regulators and as Wall Street increasingly embraces the asset class.

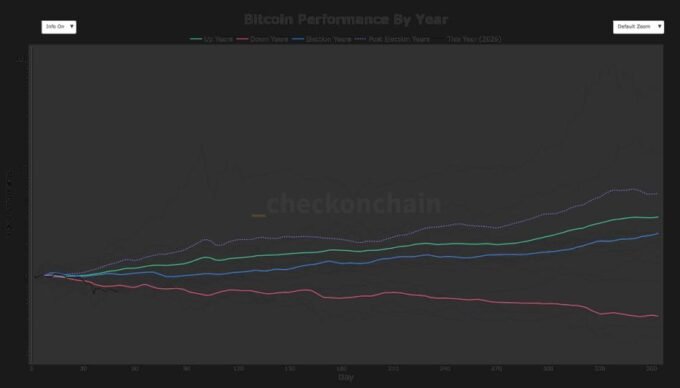

Glimmers of Hope: Analysts Eye a Potential Rebound

Despite the prevailing gloom, this puzzling scenario has instilled a sense of hope among some analysts. Danny Nelson of Bitwise remains optimistic, stating, “Crypto’s reality is getting stronger. These changes are going to last well beyond the current downturn.” His sentiment is echoed by Tom Lee, co-founder of the analysis firm Fundstrat and a prominent Ethereum advocate, who recently suggested in an interview, “We’re really close to the end.” These perspectives hint at a belief that the current market correction, while painful, might be paving the way for a more resilient and mature crypto ecosystem, with a rebound potentially on the horizon.

For more details, visit our website.

Source: Link

Leave a comment