Michael Saylor’s Risky Financial Gambit: The Unseen Pivot at MicroStrategy

Michael Saylor, the visionary behind MicroStrategy (formerly Strategy), has become synonymous with an audacious corporate strategy: transforming a software firm into a Bitcoin treasury. While his unwavering commitment to the digital asset garners constant headlines, a significant and potentially perilous shift in his financial maneuvering has largely escaped public scrutiny. As Bitcoin’s price trajectory turned south, Saylor quietly initiated a torrent of share issuance, followed by a pivot to high-yield preferred stock, all in a relentless pursuit to grow MicroStrategy’s Bitcoin holdings – a strategy that is now pulling shareholders into increasingly treacherous waters.

The Genesis of a Bitcoin Empire: An “Accretion Machine”

Saylor’s journey into the Bitcoin realm began in Q2 2020. At that time, MicroStrategy had 76 million Class A common shares outstanding. Fast forward to February 12, and that number ballooned to 314 million – a staggering 4.13x or 313% increase. To put this into perspective, among hundreds of U.S. companies valued over $10 billion, the closest competitor in terms of dilution over the same period was Wayfair, with a mere 30% increase, a tenth of MicroStrategy’s figure. Twilio, in third place, saw a 27% rise.

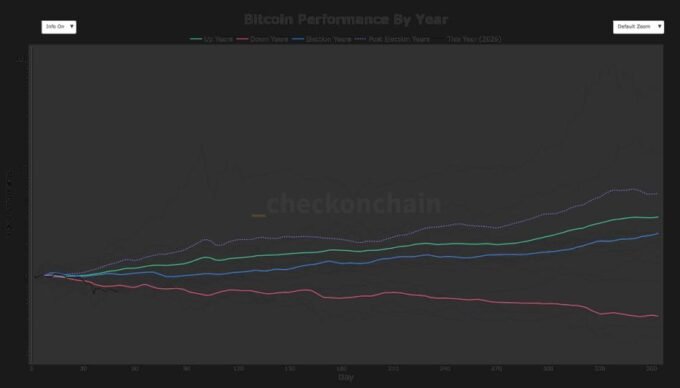

Initially, this aggressive equity issuance was a stroke of genius. MicroStrategy pioneered a model centered on continually increasing its “Bitcoin per share” (BPS). For a considerable period, the company’s stock price soared far beyond Bitcoin’s gains. This allowed Saylor to sell shares at what now appear to be highly inflated valuations, using the proceeds to acquire more Bitcoin. It was, in essence, a “magical arbitrage” – an accretion machine where shareholders effectively “owned” more Bitcoin with each passing quarter.

Consider the period from late 2023 to mid-July of the following year. MicroStrategy shares surged more than sevenfold, tripling Bitcoin’s 2.8x climb. At the outset, selling 1,000 shares could buy approximately 1.5 Bitcoin. By the time MicroStrategy’s market cap reached its summit just after Independence Day last year, the same share sale could net 3.8 tokens, a 150% increase. This strategy successfully boosted the Bitcoin held for every 1,000 shares from 1.5 at the end of 2023 to 2.12, a 41% rise, by the summer of 2025.

The Tide Turns: When Accretion Became Dilution

However, even as the market dynamics began to shift, Saylor pressed on with stock sales. MicroStrategy proudly declared itself the “biggest raiser of common equity” in the U.S. for 2025, selling $16.5 billion worth of shares and capturing 6% of the total market. But the wheels were already coming off.

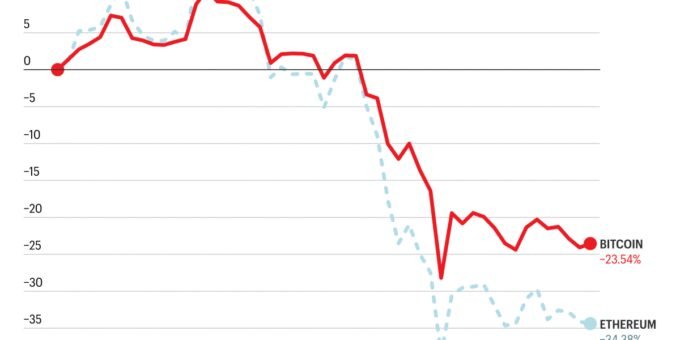

Since its peak, MicroStrategy’s shares have plummeted 72%, from $457 to $130, a far steeper decline than Bitcoin’s 51% tumble from $129 to $68 (as of Feb. 17). This dramatic divergence meant the “accretion game” was over. Every subsequent stock sale to acquire Bitcoin no longer enriched the BPS ratio; instead, it diluted it. The very metric Saylor championed – increasing Bitcoin per share – began to suffer under the weight of a falling stock price.

A Risky Pivot: Preferred Stock and Mounting Financial Pressure

Faced with the prospect of diluting his cherished BPS, Saylor executed another significant, yet less publicized, pivot: a massive issuance of preferred stock. MicroStrategy’s Q4 investor presentation highlighted its status as America’s largest issuer of preferreds last year, raising an additional $7 billion – a third of all dollars raised on Wall Street through such offerings. This substantial cash infusion from preferred shares served a critical purpose: to keep the BPS ratio relatively stable, preventing the company from becoming a “dilution machine” if it continued to rely solely on common stock sales.

This shift, however, comes with its own set of formidable challenges. MicroStrategy has already accumulated a substantial debt pile, now standing at $8.2 billion. The newly issued preferred stock carries junk bond-like rates, averaging over 10%, translating to a hefty $888 million annually in dividend payments. Furthermore, a significant $6 billion in debt is slated for refinancing in 2028. Saylor’s proposed solution? To “equitize” these borrowings by issuing even more shares. This strategy, however, hinges entirely on a resurgence in MicroStrategy’s stock price. Without another dramatic ascent, the “equitizing” formula risks further exacerbating the company’s financial strain and shareholder dilution.

Michael Saylor’s relentless pursuit of Bitcoin accumulation has led MicroStrategy down an increasingly complex and financially precarious path. The initial “accretion machine” has given way to a high-stakes balancing act, where maintaining Bitcoin per share now demands expensive preferred dividends and a future reliant on a soaring stock to avert further dilution. The question remains: can this latest gambit keep the Bitcoin dream alive without ultimately sinking shareholder value?

For more details, visit our website.

Source: Link

Leave a comment