Bitcoin, the world’s leading cryptocurrency, has stumbled out of the gate in 2026, recording its weakest start to a financial year on record. Through the first 50 days, the digital asset has seen a significant 23% decline, setting a concerning precedent for investors and market watchers alike.

An Unprecedented Double Dip: January and February Losses

The current downturn marks a historical first for Bitcoin: consecutive monthly declines in January and February. After a 10% drop in January, the cryptocurrency extended its losses with a further 15% fall in February. This back-to-back slump is particularly noteworthy as, according to Coinglass data, even in previous years with double-digit January declines (such as 2015, 2016, and 2018), February always brought a positive rebound. If this trend holds, it will also represent Bitcoin’s weakest consecutive monthly performance since 2022.

Decoding the Data: Beyond the Surface Numbers

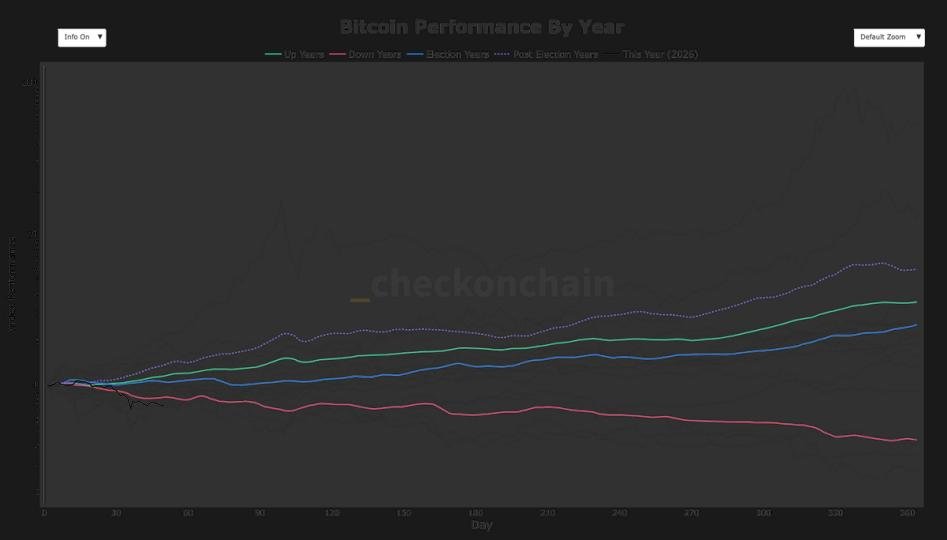

Checkonchain data further underscores the severity of the current drawdown. In a typical “down year,” the average index reading after 50 days stands at 0.84, a benchmark often used by traders to assess cyclical market corrections. Bitcoin’s current reading of 0.77 highlights the exceptional scale of its underperformance.

This weakness follows a challenging 2025, which saw a 17% decline. Historically, post-election years have often outperformed election years and shown stronger aggregate performance. This makes Bitcoin’s current struggle in a post-election year even more pronounced and a point of concern for those relying on historical market patterns.

Market Sentiment and the Road Ahead

While the article focuses on Bitcoin’s specific performance, the broader cryptocurrency market has also been navigating a complex landscape. Geopolitical nerves and shifting investor sentiment often play a significant role in the volatility of digital assets. The current record-breaking slump raises questions about immediate future trajectories and whether the market can find a catalyst for recovery.

As Bitcoin navigates this uncharted territory of consecutive early-year declines, all eyes will be on its ability to regain momentum and demonstrate the resilience it has shown in previous cycles. The coming months will be crucial in determining if this record-worst start is a temporary blip or indicative of a more prolonged period of adjustment for the world’s largest cryptocurrency.

For more details, visit our website.

Source: Link

Leave a comment