The U.S. is teetering on a fiscal precipice. With the national debt held by the public soaring past $38 trillion—a staggering 101% of GDP—and projected to hit 120% within the next decade, the nation faces an economic reckoning. While America has historically navigated fiscal challenges, the current political climate raises questions about leaders’ resolve to address this escalating crisis.

The Debt Crisis: No Longer a Distant Threat

Once considered a long-term concern, the national debt has rapidly evolved into an immediate and pressing danger. The nonpartisan Congressional Budget Office (CBO) recently issued a stark warning about the country’s fiscal trajectory. Beyond the sheer volume of debt, the burgeoning interest payments threaten to crowd out vital government spending, including critical programs like Social Security, which could face insolvency within years.

“The debt crisis is already here. If left unaddressed, it will only continue to worsen,” declared researchers from the Committee for Economic Development (CED), a prominent public policy think tank. Their recent report underscores the severe implications of unchecked borrowing: potential curtailment of essential services, erosion of the dollar’s global reserve currency status, and persistently high interest rates stifling long-term economic growth. Yet, the CED report also offers a glimmer of hope, suggesting that historical precedents might illuminate a path forward.

Echoes of the 1980s: A Blueprint for Bipartisan Action?

The early 1980s saw the United States grapple with a strikingly similar fiscal emergency. Social Security’s trust fund was on the brink of collapse, threatening automatic benefit cuts. This “impending crisis,” as the CED report notes, mirrors the current urgency, with the CBO projecting Social Security’s insolvency as early as October 2031.

The Greenspan Commission and the ‘Private Pact’

In 1981, President Ronald Reagan convened a 15-member bipartisan body, formally known as the National Commission on Social Security Reform, but popularly remembered as the Greenspan Commission, after its chairman, future Federal Reserve chief Alan Greenspan. Comprising lawmakers, experts, and business leaders, its mission was to rescue the program.

Initially, the commission faced a year of gridlock. Republicans resisted tax increases, while Democrats opposed benefit cuts. However, a “spirit of collaboration,” fostered through discreet, behind-the-scenes negotiations, ultimately broke the impasse. A small, dedicated subgroup of senators and White House staff meticulously bridged the partisan divide.

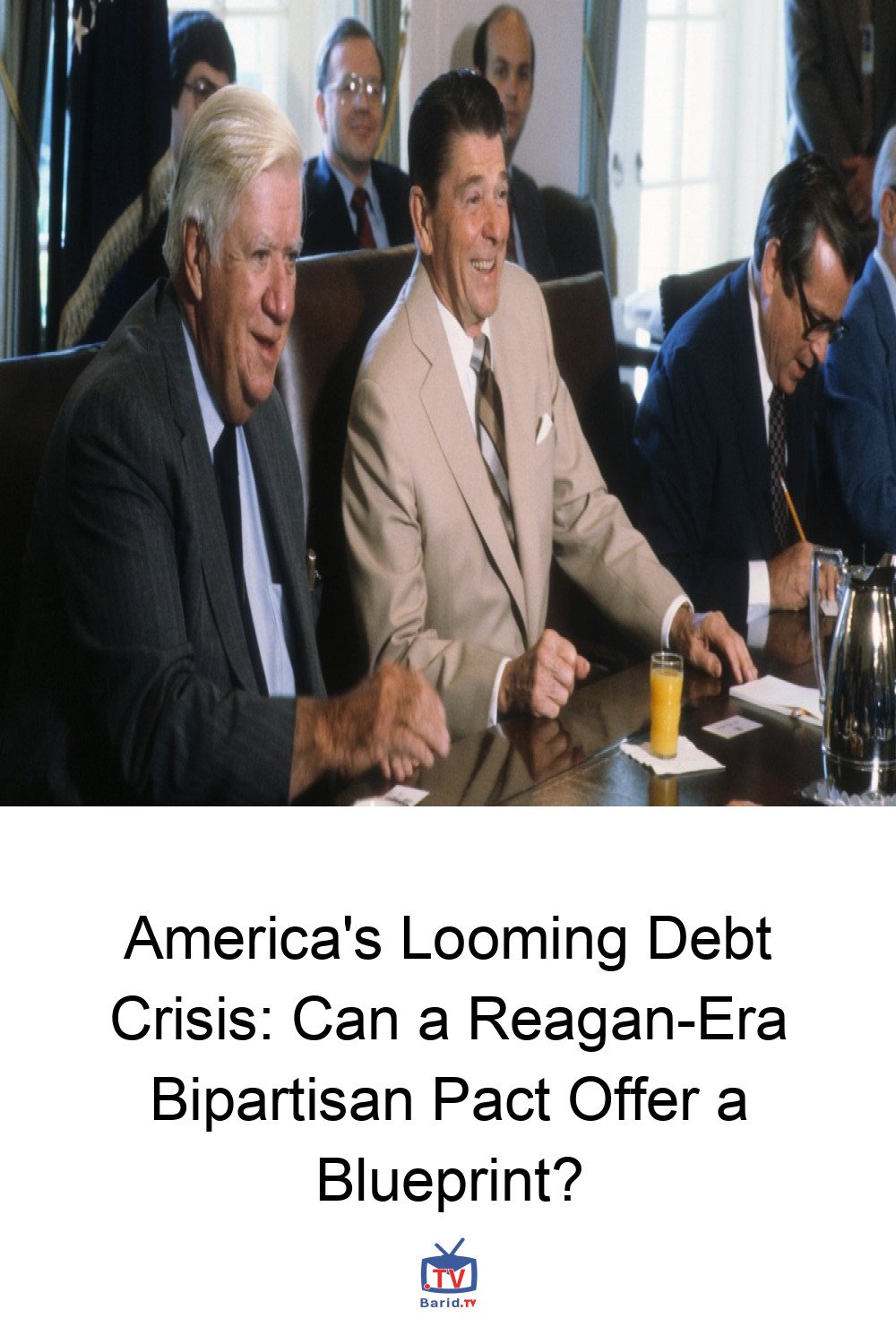

Crucially, a “private pact” between President Reagan and then-Democrat House Speaker Tip O’Neill proved instrumental. Both leaders agreed not to publicly undermine the commission’s recommendations, providing essential political cover for lawmakers to endorse difficult, yet necessary, reforms to revenue and benefits. Furthermore, an informal Senate rule mandated that any senator opposing a recommendation had to propose a viable alternative, effectively elevating the debate beyond typical partisan squabbling.

These 1983 amendments successfully shored up Social Security’s finances for decades, marking the program’s last significant reform.

A Call for Modern Bipartisanship: Challenges Ahead

The CED report advocates for a contemporary iteration of such a bipartisan commission, hailing it as a “promising solution that could break the political impasse” once more. Such a body could empower lawmakers to prioritize long-term fiscal sustainability and make the “difficult votes necessary to reset our fiscal trajectory.” With co-chairs from both parties and a bipartisan majority requirement for approval, a new commission could imbue essential reforms with much-needed credibility.

Alan Greenspan himself acknowledged the Reagan-O’Neill private agreement as the “single most important factor” behind the 1983 reforms’ success. However, forging such a spirit of collaboration today presents formidable challenges. A modern commission tasked with averting Social Security’s 2031 insolvency would confront a political landscape far more polarized than that of the early 1980s.

Navigating a ‘Broken’ System

The report cautions that establishing a new commission today risks repeating the fate of the 2010 Simpson-Bowles Commission. Formed by President Barack Obama to address the burgeoning national debt, that bipartisan effort ultimately faltered, partly due to a lack of comprehensive support from both parties. The path to fiscal stability, it seems, remains fraught with political hurdles, demanding a level of cross-aisle cooperation that has become increasingly elusive.

For more details, visit our website.

Source: Link

Leave a comment