BlockFills Halts Withdrawals Amidst Deepening Crypto Market Turmoil

Chicago-based crypto trading and lending platform BlockFills has announced a temporary suspension of client deposits and withdrawals, sending fresh ripples of concern through an already beleaguered digital assets industry. The move, disclosed in a statement on Wednesday, is framed by the company as a measure to enhance “the protection of clients and the firm,” yet it underscores the persistent volatility and uncertainty plaguing the blockchain sector.

A Familiar Echo in a Faltering Market

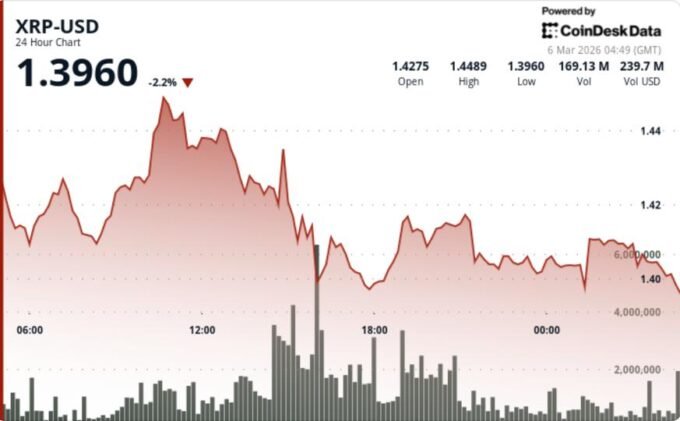

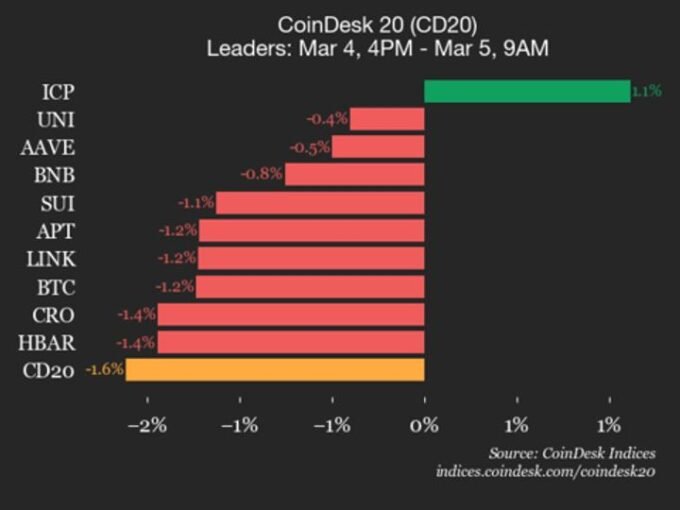

BlockFills’ decision arrives as cryptocurrencies experience a significant downturn, with major assets shedding substantial value. Bitcoin, the flagship digital currency, has plummeted approximately 48% from its October all-time high, currently hovering around $66,000, and has seen a roughly 29% decline in the past month alone. Ethereum and Solana have fared similarly, with monthly drops of 40% and 45% respectively, painting a grim picture for investors.

Operating primarily as a crypto lending platform for institutional players like hedge funds and asset managers, BlockFills facilitates liquidity by leveraging crypto as collateral. With over $60 billion in transaction volume and a client base exceeding 2,000 institutional entities, its operations are substantial, making the suspension a notable event.

Déjà Vu: The Shadow of the 2022 Crypto Winter

For many, BlockFills’ action evokes an unsettling sense of déjà vu, reminiscent of the “crypto winter” of 2022. During that period, prominent lenders such as Celsius and BlockFi similarly froze customer funds, triggering widespread panic and significant financial losses across the industry. While BlockFills may not command the same public recognition as its predecessors, its current predicament raises questions about potential contagion and whether its troubles could cascade into the broader market.

The timing is particularly poignant given recent political developments. Despite hopes that a second term for President Donald Trump might usher in a “golden era” for cryptocurrencies – a sentiment fueled by crypto-friendly legislation signed in July and a stalled landmark bill – the market has defied such optimism. Early gains seen during the first nine months of his presidency have been entirely erased, highlighting the market’s independence from political endorsements.

Uncertainty Lingers for Digital Assets

As BlockFills navigates its temporary suspension, the wider digital asset landscape remains fraught with uncertainty. The ongoing price corrections across Bitcoin, Ethereum, Solana, and other altcoins underscore a period of significant re-evaluation and risk aversion. While the company maintains its actions are for client protection, the incident serves as a stark reminder of the inherent risks and the evolving regulatory and economic pressures facing the burgeoning, yet volatile, cryptocurrency ecosystem.

For more details, visit our website.

Source: Link

Leave a comment