Conquering Tax Season: The Unmatched Ease of TurboTax’s Mobile App (2026)

As tax season looms, the annual ritual of filing taxes can often feel daunting. Yet, for millions, the process has been significantly streamlined thanks to innovations in digital tax preparation. For years, TurboTax has stood out as a frontrunner in the DIY tax service landscape, consistently lauded for its intuitive design, comprehensive support, and cost-effective solutions. This year, we take a closer look at the TurboTax mobile app experience, particularly for those looking to file their taxes independently in 2026.

The TurboTax Advantage: Designed for the Filer

TurboTax distinguishes itself by putting the user at the forefront. Its mobile application boasts an exceptionally user-friendly interface, making complex tax requirements digestible and manageable. Beyond the smooth navigation, users benefit from readily available expert assistance, diverse options for document auto-upload, and a wealth of helpful tips and information tailored to their specific tax situation. The platform’s commitment to transparency is evident in its clear, low-cost options designed to cater to every type of filer.

For returning users, the convenience is unparalleled. TurboTax intelligently stores previous years’ information, enabling effortless auto-upload and recalling past choices and forms. This continuity dramatically cuts down filing time, making it a fraction of what one might experience with other services.

Unlock Free Filing: Your Guide to $0 Federal and State Taxes

For those new to TurboTax, an enticing offer awaits: the opportunity to file both federal and state taxes for free. This incredible deal is designed to introduce new users to the platform’s capabilities, but comes with specific requirements:

- You must be a new TurboTax user, switching from another provider.

- Filing must be initiated and completed entirely within the TurboTax mobile app by February 28.

- This offer applies exclusively to DIY (self-guided) tax services and excludes expert-assist products.

- It is eligible for Simple Form 1040 returns only, meaning no complex schedules are included, with exceptions for EITC, CTC, student loan interest, and Schedule 1-A forms.

While some competitors, like FreeTaxUSA, offer low-cost options, they often charge for state returns (e.g., $16). TurboTax, last year, processed more than double the free returns compared to FreeTaxUSA, underscoring its commitment to accessible tax filing. This tax season, over 100 million Americans are eligible for free filing with TurboTax through the mobile app.

Navigating Your Options: Beyond Free Filing

Even if you’re a returning user or have more complex tax situations, TurboTax offers a spectrum of services to meet your needs:

- DIY (Do-It-Yourself): The self-guided option with step-by-step instructions, eligible for the free filing deal for new mobile app users.

- Expert Assist: Get help from tax experts throughout the process, with a final review by an expert before submission.

- Expert Full Service: Have your taxes prepared entirely by a local tax expert.

Pricing for these tiers varies based on the chosen service and the timing of your filing. Filing earlier, especially before March, generally secures more favorable rates.

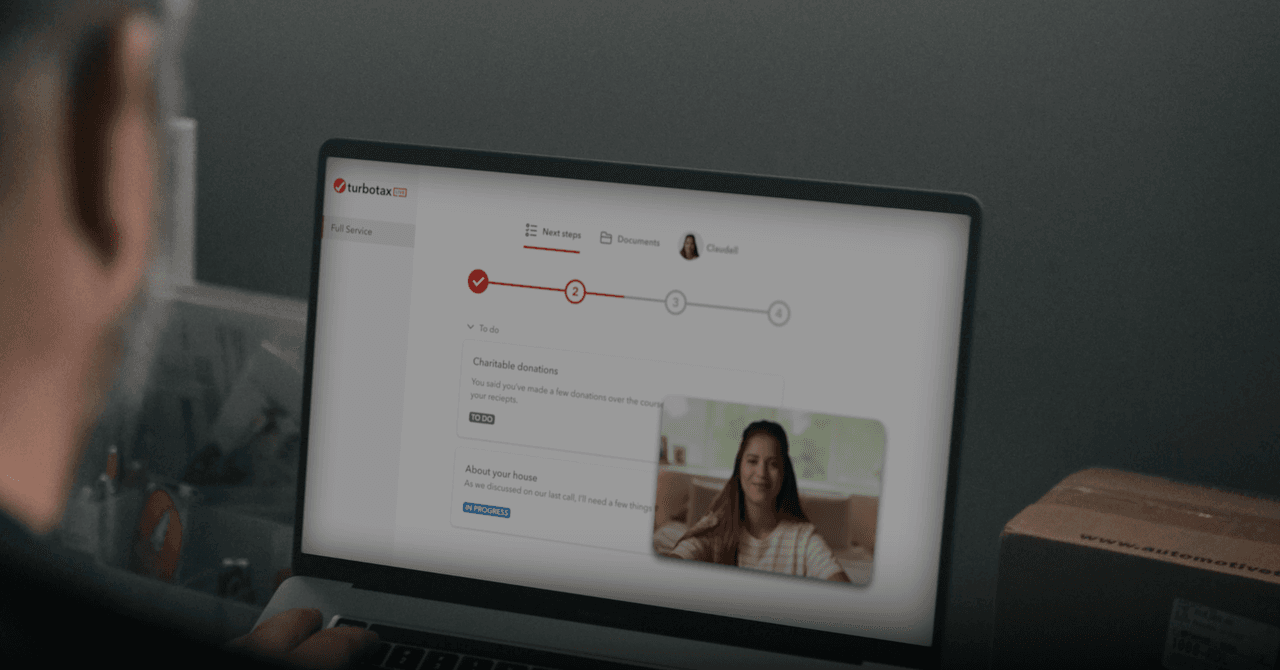

A Walkthrough of the Mobile Filing Process

The TurboTax mobile app streamlines the filing journey from start to finish:

Personalized Questionnaires and Time Estimates

The process begins with a smart questionnaire that tailors the experience to you, identifying relevant sections like dependents, assets, and education. Uniquely, TurboTax also provides an estimated completion time and asks how you filed last year, offering valuable foresight into the process length.

Effortless Document Upload and Pre-filling

Gone are the days of manual data entry. You can easily upload documents or snap pictures directly with your phone. The app’s advanced capabilities pre-fill a significant amount of data, drastically cutting down on time. Simply taking a picture of a document can populate all necessary information on the desktop page.

Automated Expense Tracking and Accuracy Checks

The app’s automation extends to pulling transaction history from your online bank accounts, helping identify potential write-offs—a boon for freelancers or those with business expenses. Furthermore, it continuously checks for completeness after each section, flagging any empty boxes to ensure accuracy and maximize your refund.

Enhanced Integration with Credit Karma

For users already leveraging Intuit’s Credit Karma for financial tracking, the partnership with TurboTax elevates the experience. This integration provides step-by-step guidance, rigorous accuracy checks, and TurboTax’s Max Refund Guarantee. Crucially, some information from your Credit Karma profile can be pre-filled, saving time and enabling more accurate refund tracking and financial planning. Advanced security features, including multifactor authentication and biometric recognition, offer added peace of mind.

In conclusion, TurboTax’s mobile app continues to set a high bar for DIY tax preparation. Its blend of user-centric design, robust features, and accessible expert support makes it a compelling choice for anyone looking to navigate tax season with confidence and ease, especially with the attractive free filing options available for new users.

For more details, visit our website.

Source: Link

Leave a comment