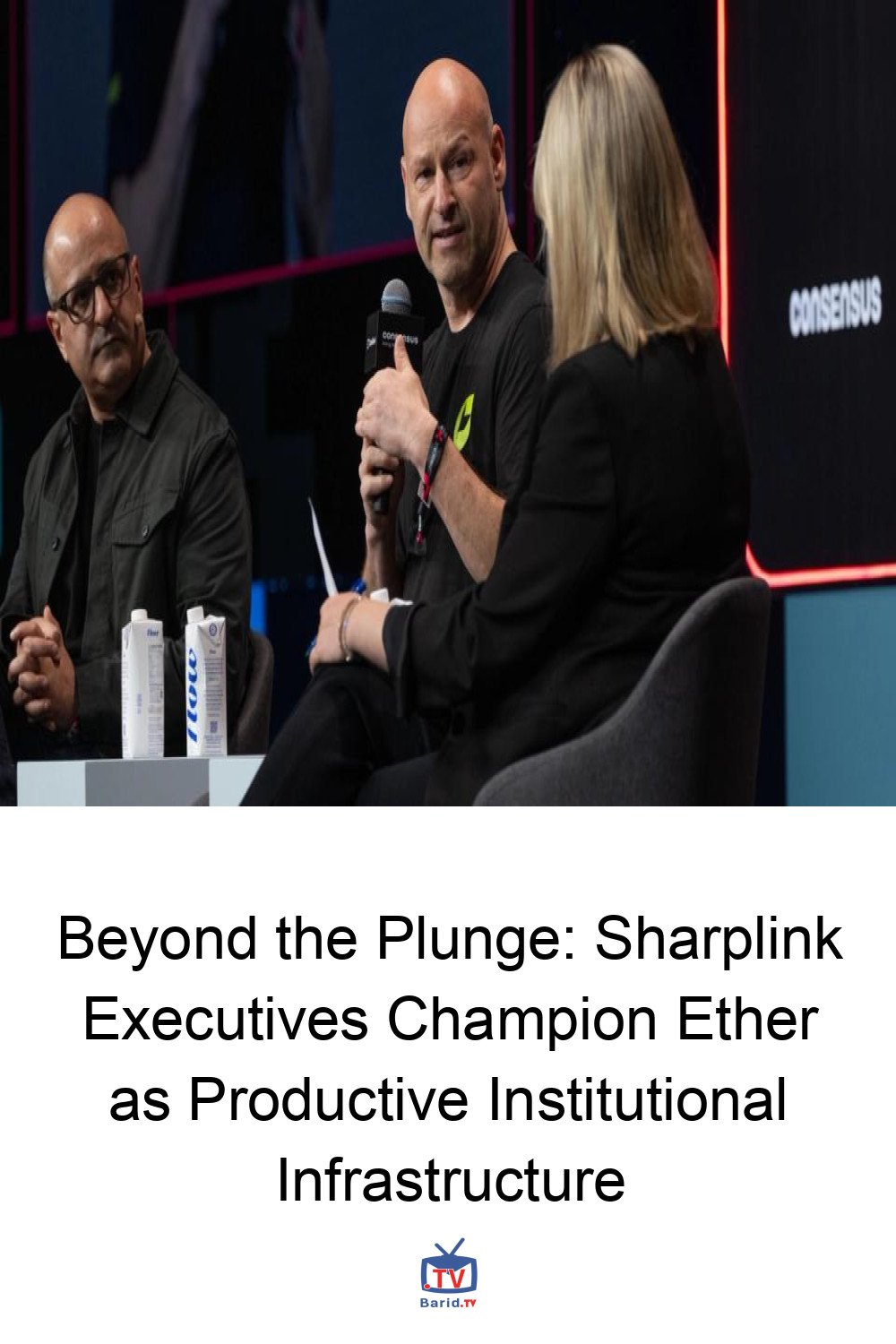

Amidst a turbulent market, where digital asset prices have seen significant plunges, Sharplink Gaming executives Joe Lubin and Joseph Chalom are boldly advocating for a paradigm shift: treating Ether (ETH) not merely as a speculative investment, but as a foundational, productive financial infrastructure. Speaking at Consensus Hong Kong 2026, the duo outlined how Digital Asset Treasuries (DATs) are rapidly evolving into a sophisticated institutional strategy, offering a new playbook for corporate engagement with the crypto economy.

The Evolving Role of Ether in Institutional Finance

From Investment to Infrastructure

The traditional view of digital assets as volatile, short-term investments is giving way to a more mature perspective. Lubin, Chairman of Sharplink Gaming and founder of ConsenSys, alongside Sharplink CEO Joseph Chalom, highlighted this critical evolution. They argue that as institutional adoption deepens, Ether’s utility extends far beyond its price action, positioning it as a dynamic engine for financial innovation.

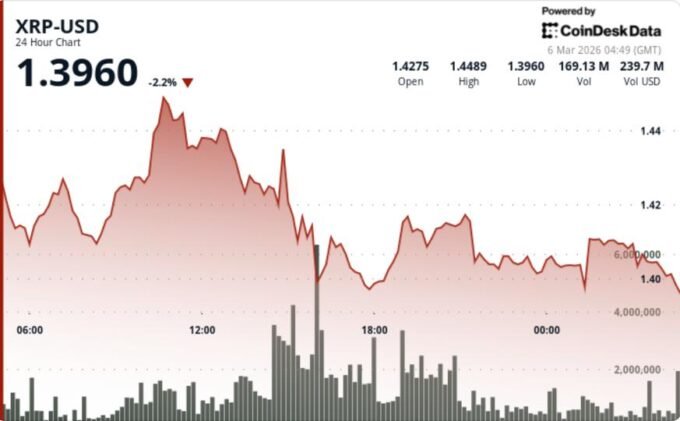

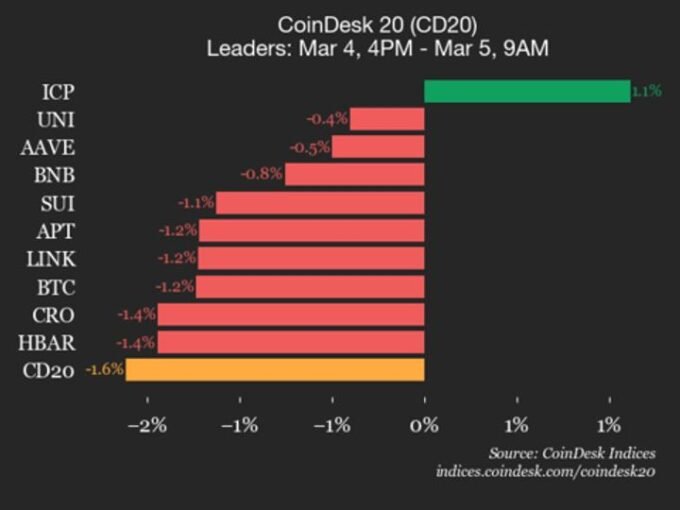

Navigating Market Turbulence

The discussion comes at a crucial time. Sharplink Gaming itself, which saw its stock surge last May following the adoption of an Ether treasury strategy, has since experienced a downturn mirroring the broader market. This volatility serves as a stark reminder of the asset class’s inherent risks. However, Chalom frames these fluctuations as part of a larger macro de-risking trend, asserting that major institutional players are actively preparing to integrate Ether into their long-term strategies.

The Case for Permanent Capital and Yield

Macro Tailwinds and BlackRock’s Vision

Chalom expressed unwavering confidence in Ethereum’s underlying strength, citing “macro tailwinds” that are stronger than ever in its decade-long history. He pointed to the explosive growth of stablecoins and tokenization, echoing BlackRock CEO Larry Fink’s prediction of $14 trillion in tokenized assets, with over 65% currently leveraging the Ethereum network. This, Chalom suggests, signals an undeniable institutional embrace.

Differentiating from ETFs: The Power of Permanent Capital

A key distinction in Sharplink’s approach, Chalom explained, lies in its deployment of “permanent capital” versus the daily liquidity demands of an ETF. While ETFs offer passive exposure, Sharplink’s strategy involves owning and actively utilizing Ether as a long-term asset. “The third stage — which is actually most important — is making your ETH productive,” Chalom emphasized, setting the stage for their yield-focused model.

Unlocking Ether’s Productive Potential: Staking and DeFi

Lubin underscored Ether’s unique characteristic: its ability to yield. “Ether would be a much better asset… because it is a productive asset. It yields. It has a risk-free rate,” he stated, referring to staking returns of approximately 3%. Sharplink has already staked nearly all its Ether holdings and plans continued accumulation and staking to generate consistent yield. Beyond simple staking, Chalom introduced the concept of “good institutional DeFi,” advocating for the use of long-term locked capital to achieve risk-adjusted returns, rather than chasing high-risk, venture-style outcomes. This approach, he believes, will elevate the standards and integrity of the broader DeFi ecosystem.

The Future is On-Chain

Lubin drew a compelling parallel to the early internet era. “A long time ago…there were internet companies. Now every company is an internet company. Soon, every company is going to be a blockchain company,” he predicted. This vision suggests a future where firms routinely hold tokens on their balance sheets and require sophisticated on-chain treasury management tools, making the strategies pioneered by companies like Sharplink not just innovative, but essential.

For more details, visit our website.

Source: Link

Leave a comment