Top-performing investment strategies for conservative growth: A complete guide

Introduction

Investing in the stock market can be a daunting task, especially for those who are new to the world of finance. With so many investment options available, it can be difficult to know where to start. However, for those who are looking for conservative growth, there are several top-performing investment strategies that can help you achieve your financial goals. In this guide, we will explore the top-performing investment strategies for conservative growth, and provide you with a comprehensive overview of each strategy.

1. Dividend Investing

- Dividend investing

involves investing in stocks that pay out a regular dividend to shareholders.

Dividend-paying stocks tend to be more stable and less volatile than growth stocks.

Dividend investing can provide a regular stream of income and help to reduce overall portfolio risk.

2. Index Funds

- Index funds

are a type of mutual fund that tracks a specific stock market index, such as the S&P 500.

- Index funds offer broad diversification and can provide a low-cost way to invest in the stock market.

- Index funds tend to be less volatile than individual stocks and can provide a more stable return.

3. Bond Investing

- Bond investing involves lending money to a borrower in exchange for regular interest payments.

- Bond investing can provide a regular stream of income and help to reduce overall portfolio risk.

- Bond investing tends to be less volatile than stock investing and can provide a more stable return.

4. Real Estate Investing

- Real estate investing involves investing in real estate, such as rental properties or real estate investment trusts (REITs).

- Real estate investing can provide a regular stream of income and help to reduce overall portfolio risk.

- Real estate investing tends to be less volatile than stock investing and can provide a more stable return.

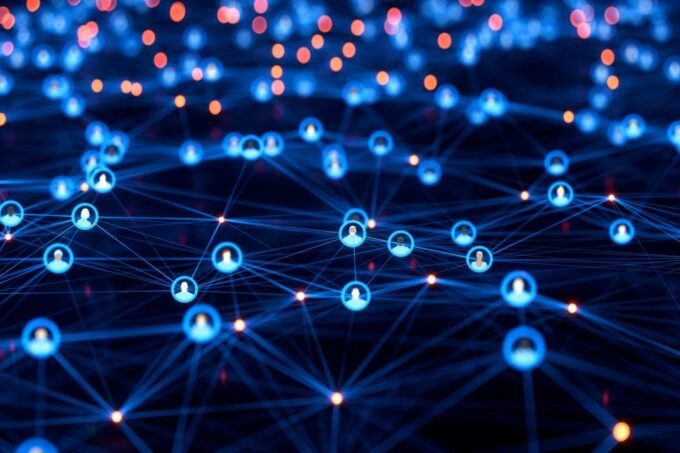

5. Peer-to-Peer Lending

- Peer-to-peer lending involves lending money to individuals or small businesses in exchange for regular interest payments.

- Peer-to-peer lending can provide a regular stream of income and help to reduce overall portfolio risk.

- Peer-to-peer lending tends to be less volatile than stock investing and can provide a more stable return.

Conclusion

Investing in the stock market can be a daunting task, but with the right strategies, you can achieve conservative growth and achieve your financial goals. The top-performing investment strategies for conservative growth include dividend investing, index funds, bond investing, real estate investing, and peer-to-peer lending. By understanding these strategies and incorporating them into your investment portfolio, you can reduce overall portfolio risk and achieve a more stable return.

Leave a comment