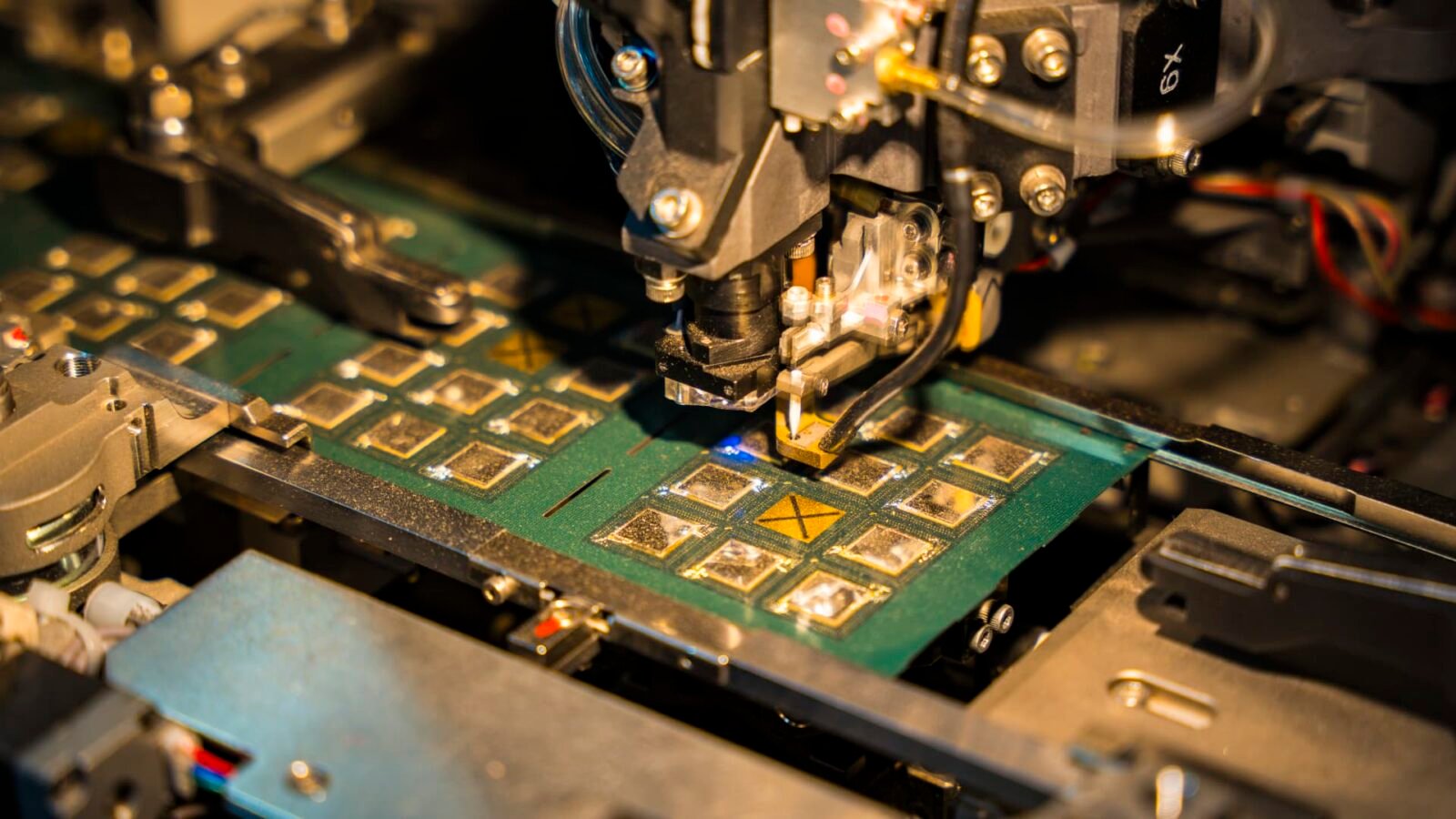

In a resounding affirmation of investor confidence in China’s burgeoning technology sector, Montage Technology, a leading Chinese interconnect chip designer, witnessed a spectacular trading debut on the Hong Kong Stock Exchange this Monday. Shares of the Shanghai-based firm soared by over 60%, significantly surpassing its initial offering price and raising a substantial $902 million.

Montage Technology’s Stellar Market Entry

Montage Technology’s shares closed at an impressive 175 Hong Kong dollars ($22.39), a remarkable leap from its offering price of HK$106.89, which was already at the upper end of its targeted range. Founded in 2004, the company has carved a niche in developing crucial infrastructure chips vital for high-performance computing, advanced data centers, and cutting-edge artificial intelligence applications.

The overwhelming investor enthusiasm was palpable during the initial share sale. The Hong Kong public tranche was oversubscribed more than 700 times, while the international offering saw nearly 38 times coverage. This robust demand underscores a strong appetite for Chinese companies operating in the AI and semiconductor space, despite prevailing global economic uncertainties and geopolitical tensions surrounding chip technology.

Montage Technology is not new to public markets, already boasting a significant presence on the mainland with a market capitalization estimated at around $27 billion, according to LSEG data.

Beijing’s Push for Chip Self-Sufficiency Fuels IPO Wave

Montage Technology’s successful listing is part of a broader trend of Chinese semiconductor firms leveraging capital markets. Recent months have seen a flurry of IPOs, including GigaDevice Semiconductor and OmniVision Integrated Circuits in January, alongside other notable debuts from Biren Technology, MetaX, Moore Threads, and Shanghai Iluvatar CoreX Semiconductor.

This surge in public offerings aligns directly with Beijing’s strategic imperative to achieve greater self-sufficiency in advanced chip technology. China aims to reduce its reliance on foreign, particularly American, designers amidst ongoing export controls that restrict the sale of the most sophisticated chips to the country.

Navigating a Complex Competitive and Geopolitical Landscape

While China’s domestic chip industry is gaining momentum, the competitive landscape remains fierce. Chinese tech behemoth Huawei, through its chip unit HiSilicon, already commands a leading share of the domestic AI chip market, presenting a formidable challenge to new entrants and established players alike.

Adding another layer of complexity, the market dynamic for advanced AI chips in China could soon see a significant shift. Following a recent decision by the Trump administration, Nvidia, a global leader in GPU technology, has been cleared to sell its H200 chip to China. Although the H200 is not Nvidia’s absolute cutting-edge technology, it represents a substantial upgrade in power compared to any AI chip previously available in the Chinese market.

Reports from Reuters indicate that China approved an initial batch of H200 imports in late January for major domestic tech companies such as ByteDance, Alibaba, Tencent, and DeepSeek. However, these approvals are reportedly subject to specific, yet-to-be-finalized conditions from Beijing, signaling a cautious and controlled integration of foreign advanced technology.

The Road Ahead for China’s Semiconductor Ambitions

Montage Technology’s impressive debut is a testament to the resilience and growth potential within China’s semiconductor industry. Yet, the sector operates within a delicate balance of ambitious national strategies, intense domestic competition, and evolving international trade policies. As China continues its determined pursuit of technological independence, the performance of companies like Montage Technology will be closely watched as key indicators of its progress and challenges.

For more details, visit our website.

Source: Link

Leave a comment