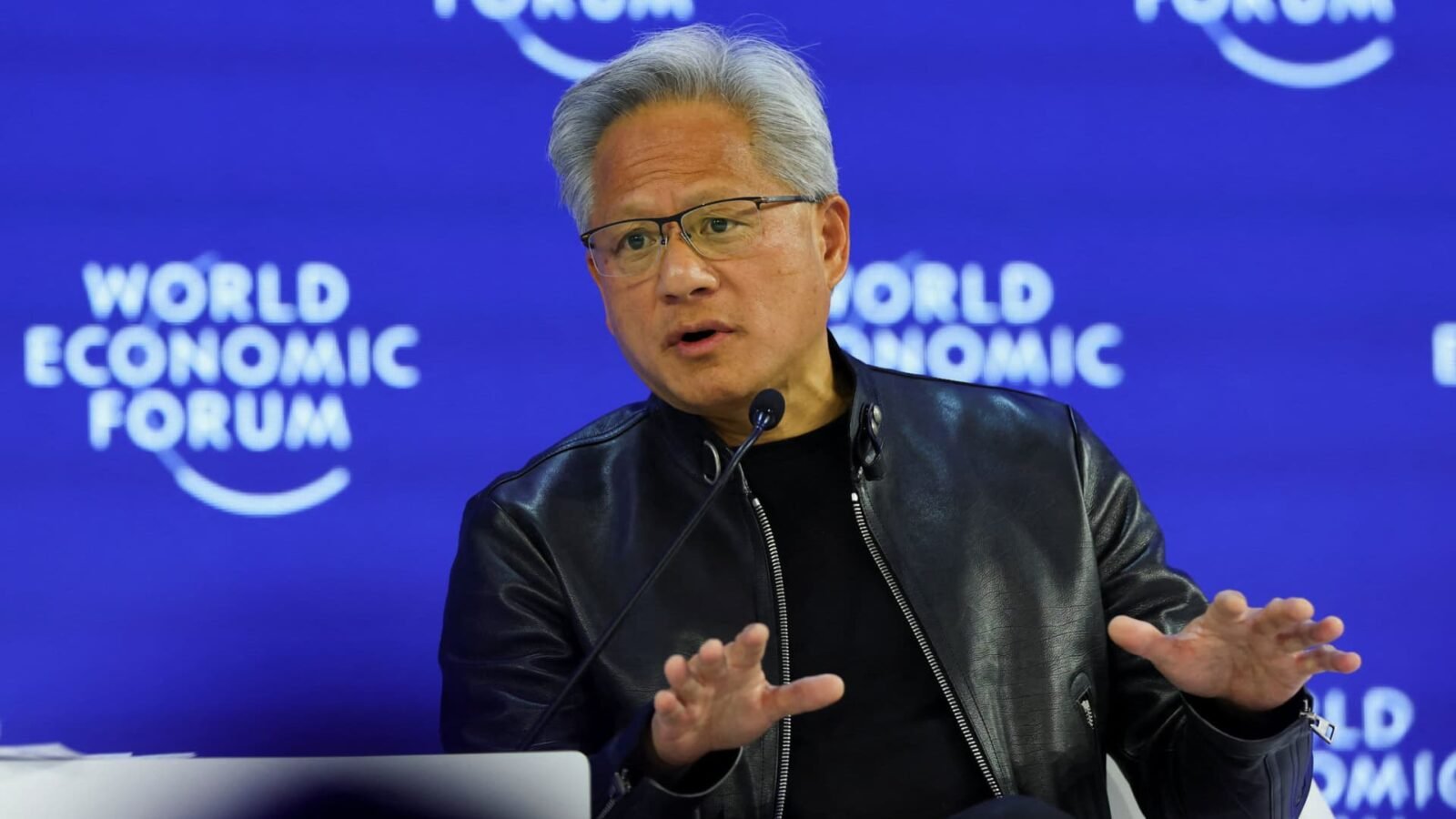

Nvidia CEO Jensen Huang has confidently declared the tech industry’s monumental $660 billion capital expenditure on AI infrastructure not just appropriate, but entirely sustainable. His remarks, made on CNBC’s “Halftime Report,” sent Nvidia shares soaring by nearly 8%, underscoring investor confidence in the burgeoning artificial intelligence sector.

The Unprecedented AI Infrastructure Buildout

Huang’s comments arrive on the heels of recent earnings reports from tech giants Meta, Amazon, Google (Alphabet), and Microsoft – all pivotal Nvidia customers. These hyperscalers have signaled aggressive plans to dramatically escalate their spending on AI infrastructure this year, collectively earmarking an astounding $660 billion. A significant portion of this colossal investment is slated for Nvidia’s cutting-edge chips, the very backbone of modern AI.

While Wall Street’s initial reaction to this spending spree was mixed – boosting Meta and Alphabet while tempering Amazon and Microsoft’s stock – Huang remains unfazed. He characterizes this period as the “largest infrastructure buildout in human history,” fueled by an insatiable, “sky high” demand for computing power. This demand, he argues, directly translates into increased profitability for AI companies and hyperscalers.

Why the Investment is Sustainable: A Profit-Driven Ecosystem

According to Huang, the sustainability of this massive capital outlay stems from a simple yet powerful economic principle: profitability. “To the extent that people continue to pay for the AI and the AI companies are able to generate a profit from that, they’re going to keep on doubling, doubling, doubling, doubling,” he asserted. He anticipates a significant rise in the cash flows of these investing companies, further justifying their strategic expenditures.

Real-World AI Applications Driving Demand

Huang provided compelling examples of how Nvidia’s technology is being leveraged across the industry:

- Meta: Transitioning from CPU-based recommendation systems to advanced generative AI and agent-driven platforms.

- Amazon Web Services (AWS): Utilizing Nvidia chips and AI to revolutionize product recommendations for the retail behemoth.

- Microsoft:

Integrating Nvidia-powered AI to enhance its extensive suite of enterprise software solutions.

He also lauded leading AI research labs, OpenAI and Anthropic, both of which rely on Nvidia chips via cloud providers. Huang highlighted their robust financial performance, stating, “Anthropic is making great money. Open AI is making great money.” He even revealed Nvidia’s substantial investments in both, including a $10 billion stake in Anthropic last year and plans for heavy investment in OpenAI’s upcoming fundraising round. His belief is that increased compute power directly correlates with exponential revenue growth: “If they could have twice as much compute, the revenues would go up four times as much.”

Enduring Demand for Nvidia’s Processing Power

A testament to the enduring demand for AI computing, Huang noted that even Nvidia’s older Graphics Processing Units (GPUs), such as the six-year-old A100 chips, are currently being rented out. This consistent utilization underscores the critical role Nvidia’s hardware plays in the ongoing AI revolution and validates the industry’s sustained commitment to building out its AI capabilities.

As long as the economic engine of AI continues to generate substantial profits, Jensen Huang believes the current trajectory of exponential investment and infrastructure expansion is not merely a trend, but a sustainable foundation for the future of computing.

For more details, visit our website.

Source: Link

Leave a comment