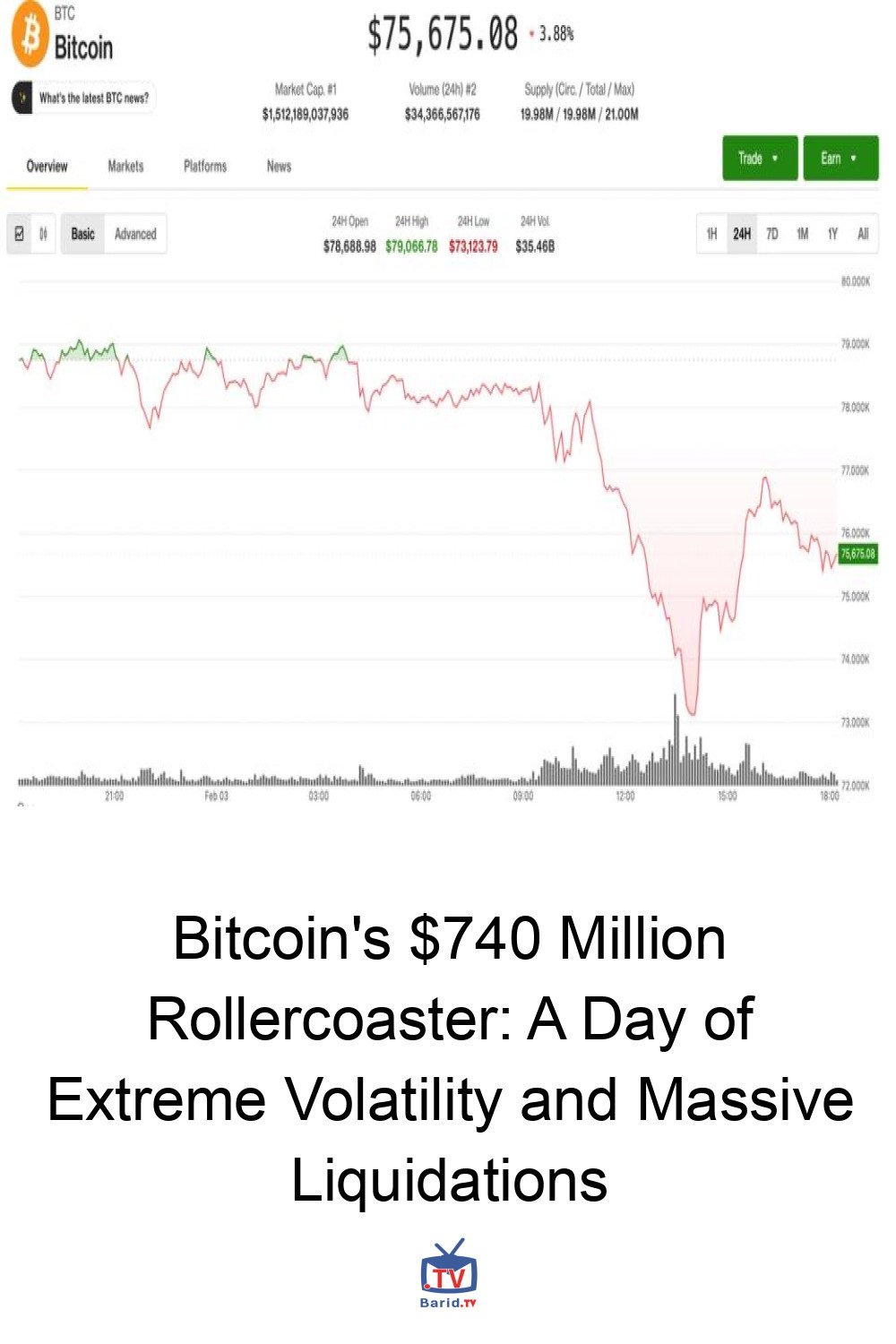

Tuesday proved to be a day of extraordinary turbulence for the cryptocurrency market, with Bitcoin (BTC) leading a dramatic rollercoaster ride that saw the digital asset plunge to a 14-month low before staging a significant rebound. This intense volatility triggered a staggering $740 million in liquidations across the derivatives market, leaving a trail of both despair and cautious optimism in its wake.

Bitcoin’s Tumultuous Trajectory

The world’s largest cryptocurrency, Bitcoin, endured a whiplash-inducing session. Early in the U.S. trading hours, BTC plummeted to $72,900, marking its weakest point since November 2024. This sharp downturn sent jitters through the market, reminiscent of broader tech-sector turmoil. However, the capitulation was short-lived. Bitcoin swiftly reversed course, rallying an impressive 5% off its lows to climb back above the $76,000 mark, reaching $76,800 before some of the gains receded. Ethereum (ETH) mirrored this volatile dance, bouncing 10% from its session lows to briefly surpass $2,300.

A Deluge of Liquidations

The abrupt price swings had a profound impact on leveraged positions. According to CoinGlass data, total liquidations across digital asset derivatives soared to $740 million within a 24-hour window. The vast majority of this financial carnage was borne by “long” positions – traders betting on higher prices. A staggering $287 million in BTC longs and $267 million in ETH longs were flushed from the market, highlighting the extreme leverage prevalent in the crypto ecosystem and the brutal efficiency of market corrections.

Behind the Rebound: Political Relief and Tech Reassurance

The market’s sudden pivot from despair to recovery wasn’t without its catalysts. A significant factor was the news that the U.S. Congress had successfully reached a deal to avert a partial government shutdown. This political resolution offered a much-needed dose of near-term stability to broader financial markets, including risk assets like cryptocurrencies.

Further bolstering sentiment was an appearance by Nvidia CEO Jensen Huang on CNBC. Huang decisively dismissed swirling speculation about friction between the chipmaking giant and OpenAI, the creator of ChatGPT. “There’s no controversy at all. It’s complete nonsense,” Huang stated, reaffirming Nvidia’s commitment to invest in OpenAI’s next fundraising round. His comments helped to calm nerves amid growing concerns over OpenAI’s stability, which had been a key driver of the AI-fueled tech rally and, by extension, broader market confidence.

Technical Crossroads: What Lies Ahead?

Despite the spirited rebound, the technical landscape for Bitcoin remains complex. The initial plunge saw BTC breach its April 2025 “tariff tantrum” lows, a move that analysts consider a significant technical breakdown. This breach raises the specter of a deeper correction, suggesting that the recent volatility might be more than just a fleeting event.

Analyst’s Outlook: Countertrend Rally or “Hell of a Year”?

Benjamin Cowen, founder of Into The Cryptoverse analytics firm, offered a nuanced perspective. He suggested that the prevailing overwhelming bearish sentiment might paradoxically pave the way for a short-term countertrend rally. Historically, Cowen noted, Bitcoin often triggers relief rallies after sweeping prior lows, as a sort of market reset.

However, Cowen also issued a stern warning: a failure for Bitcoin to establish a sustained bounce soon could usher in “one hell of a midterm year.” He drew parallels to previous bear markets in 2018 and 2022, which coincided with U.S. midterm elections, implying a potential for prolonged downturns if current support levels don’t hold. “I feel like the bear narrative has been really strong for a while, and so I would expect a countertrend rally soon so that it gives the bulls some hope for a while,” Cowen shared in an X post, encapsulating the market’s current tightrope walk between hope and apprehension.

As the dust settles from Tuesday’s dramatic events, the crypto market remains on high alert. While the immediate rebound offered some respite, the underlying technical vulnerabilities and the analyst’s cautionary notes suggest that investors should brace for continued volatility and carefully monitor Bitcoin’s ability to establish a firm footing in the coming weeks.

For more details, visit our website.

Source: Link

Leave a comment