A brutal winter storm sweeping across the United States has delivered a significant blow to the Bitcoin mining industry, forcing major operators to curtail operations and sending the network’s hashrate plummeting. This dramatic downturn marks the most severe decline since China’s sweeping mining ban in 2021, raising concerns about miner profitability and the resilience of the network.

Bitcoin Hashrate Plunges Amidst US Winter Storms

According to data from CryptoQuant, Bitcoin’s total network hashrate has experienced a sharp 12% reduction since November 11. This substantial drop is the largest recorded since October 2021, a period when the network was still reeling from the exodus of miners from China. The primary catalyst for this recent contraction has been extreme winter weather conditions in key US mining regions, which have severely disrupted power supply and compelled miners to temporarily shut down their machines.

The hashrate, a measure of the total computational power dedicated to mining and processing transactions on the Bitcoin blockchain, now hovers around 970 exahashes per second (EH/s). This figure represents its lowest point since September 2025, highlighting the profound impact of the recent weather events. Publicly listed mining firms, in particular, have been forced to power down infrastructure, not only to protect their expensive hardware but also to comply with grid curtailment requests aimed at stabilizing local power supplies during peak demand.

Economic Fallout: Revenue and Production Take a Hit

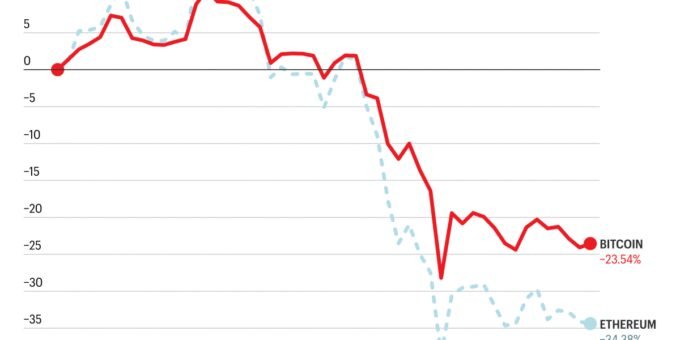

The immediate consequence of this hashrate shock has been a significant deterioration in miner economics. Daily Bitcoin mining revenue, which stood at approximately $45 million on January 22, plummeted to a yearly low of $28 million just two days later. While there has been a modest recovery to around $34 million, this figure remains well below recent averages, reflecting both the reduced network activity and a softer Bitcoin price environment.

Production figures paint an equally stark picture. Output from the largest publicly traded miners saw a drastic reduction, falling from 77 Bitcoin per day to a mere 28 Bitcoin over the same period. Non-public miners also experienced a substantial decline, with their output dropping from 403 Bitcoin to 209 Bitcoin. On a 30-day rolling basis, publicly listed miners recorded a 48 Bitcoin decline in production, the steepest since May 2024, shortly after the last halving event, while non-public miners saw a 215 Bitcoin drop, the largest since July 2024.

Miner Profitability Under Severe Stress

The energy-intensive nature of Bitcoin mining means that operational disruptions and falling revenues directly impact profitability. CryptoQuant’s Miner Profit and Loss Sustainability Index has fallen to 21, its lowest reading since November 2024. This critical index signals that a growing number of miners are operating under deeply stressed financial conditions, with their revenues struggling to cover operational costs.

Despite recent downward adjustments in mining difficulty – a mechanism that automatically recalibrates to maintain a consistent block time as hashrate fluctuates – the relief has proven insufficient to fully offset the combined pressures of lower Bitcoin prices and widespread operational disruptions. Should the hashrate remain suppressed, further difficulty cuts could be on the horizon in the coming weeks, potentially offering some much-needed margin relief for struggling miners. However, for now, the data suggests that the Bitcoin mining sector is navigating one of its most challenging periods since the fundamental reset that followed the China ban over four years ago.

For more details, visit our website.

Source: Link

Leave a comment