In the tumultuous waters of the cryptocurrency market, a fascinating and stark divergence is unfolding as Bitcoin navigates a significant selloff. While the broader retail investor base appears to be in a frantic race for the exit, shedding their holdings amidst price volatility, a powerful and often enigmatic group — the ‘mega-whales’ — are quietly executing a strategic accumulation, buying into the dip with conviction.

The Great Bitcoin Divide: Panic vs. Patience

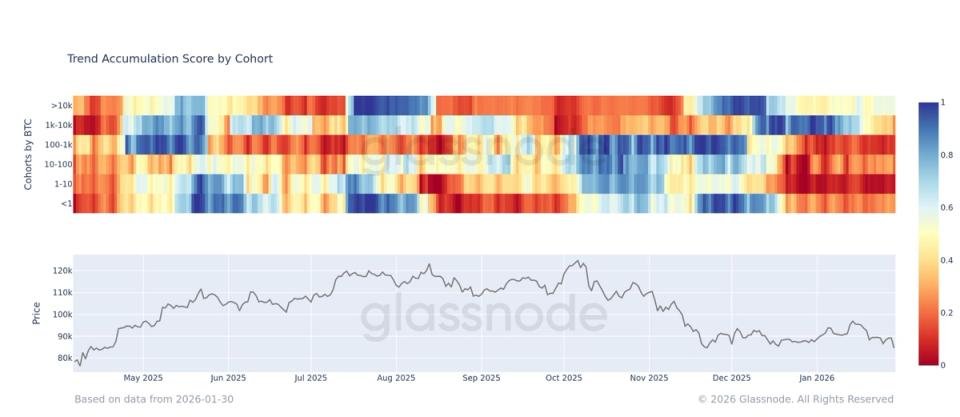

On-chain analytics firm Glassnode has unveiled compelling data that paints a clear picture of this market dichotomy. Their latest insights reveal that wallets holding a staggering 10,000 BTC or more are not just holding steady; they are actively in an accumulation phase. This elite cohort stands alone, maintaining a neutral to slightly positive trend in their Bitcoin balances, even as the market experiences significant downward pressure.

This strategic buying by the largest players stands in stark contrast to the behavior of smaller investors. Data indicates that all other cohorts, particularly those holding less than 10 BTC, are firmly in a distribution phase, signaling a widespread sell-off among retail participants driven by fear and risk aversion.

Whales Feast on the Dip

The evidence of institutional and large-scale investor confidence is further bolstered by the increasing number of entities holding substantial amounts of Bitcoin. Glassnode reports a notable rise in the number of wallets holding at least 1,000 BTC, climbing from 1,207 in October to 1,303 by late January 2026. This upward trajectory suggests that significant players are strategically absorbing supply, viewing the current correction as a prime opportunity for long-term positioning.

Since Bitcoin’s all-time high in October, this growth in larger holdings reinforces the narrative that ‘smart money’ is actively buying into the market’s downturn. These whales, with their deep pockets and often longer investment horizons, are demonstrating a classic contrarian strategy: buying when others are selling.

Retail Retreat: A Sign of Continued Uncertainty

Conversely, the persistent selling by retail investors, particularly those with less than 10 BTC, highlights a continued sentiment of downside risk and caution among smaller participants. This group has been in a sustained selling trend for over a month, reflecting a broader market unease that has seen Bitcoin consolidate within an $80,000 to $97,000 range since late November, before recently dipping to around $78,000.

Glassnode’s Accumulation Trend Score by wallet cohort, which assesses buying and selling behavior over a 15-day period, underscores this divergence. Scores closer to 1 signify accumulation, while values near 0 indicate selling. The largest whales are registering a “light accumulation” phase, while smaller cohorts are consistently trending towards distribution.

What This Means for the Market

This fascinating divergence between large-scale and retail investors offers a critical lens through which to view Bitcoin’s current market dynamics. While retail panic can fuel short-term volatility, the quiet accumulation by ‘mega-whales’ often signals underlying confidence in Bitcoin’s long-term value proposition. It suggests that despite the immediate price pressures, powerful market participants are positioning themselves for future growth, potentially absorbing supply that will be crucial for the next upward trajectory.

As Bitcoin continues its journey, the actions of these market titans will undoubtedly remain a key indicator for observers attempting to gauge the cryptocurrency’s future direction.

For more details, visit our website.

Source: Link

Leave a comment