Silver’s Shockwave: How a Metals Plunge Upstaged Bitcoin in Crypto Liquidations

In a surprising turn of events that sent ripples through the digital asset landscape, tokenized silver futures recently dominated liquidation charts across crypto markets, eclipsing both Bitcoin and Ether. This unprecedented shake-up, triggered by a sharp downturn in precious metals and amplified by leveraged trading, highlights a significant evolution in how crypto venues are being utilized by macro traders.

A Rare Reversal: Silver Outperforms Crypto Giants in Liquidations

For 24 hours, the crypto world witnessed an unusual spectacle: tokenized silver futures recorded the largest liquidations, wiping out approximately $142 million. This figure dramatically surpassed Bitcoin’s $82 million and Ether’s nearly $139 million in losses during the same period. Typically, Bitcoin and Ether, as the bedrock of the crypto economy, lead such tables. The shift signals a growing trend where crypto platforms are no longer solely playgrounds for digital asset speculation but are increasingly serving as sophisticated rails for broader macroeconomic bets.

The Perfect Storm: What Drove the Silver Sell-Off?

Several converging factors contributed to silver’s dramatic 35% plunge and the subsequent crypto liquidation shock:

- Metals Market Reversal: Silver prices experienced a sharp reversal after an earlier rally, putting significant pressure on positions.

Hedge Fund Retreat:

Large speculators and hedge funds drastically cut their bullish silver bets to a 23-month low, reducing net-long exposure by 36% in the week leading up to January 27.- CME Group’s Margin Hike: In a move to cool volatility, CME Group announced an increase in margin requirements for gold and silver futures by up to 50%. Higher margins often force leveraged traders to either inject more capital or close positions, exacerbating price swings.

This confluence of events created a potent cocktail for tokenized silver, especially given the leverage-heavy nature of trading on crypto venues.

Crypto Venues: The New Macro Trading Frontier

The episode underscores a pivotal shift in the utility of crypto platforms. Traders are increasingly leveraging tokenized instruments – digital representations of traditional assets like gold, silver, and copper – to express views on commodities, currencies, and interest rates. These products offer round-the-clock trading and often require less upfront capital compared to traditional futures accounts, making them attractive during periods of rapid macro shifts.

The largest single liquidation order, a staggering $18.1 million leveraged XYZ:SILVER-USD position on Hyperliquid, serves as a stark reminder of the risks involved and the scale of capital now flowing through these alternative trading rails.

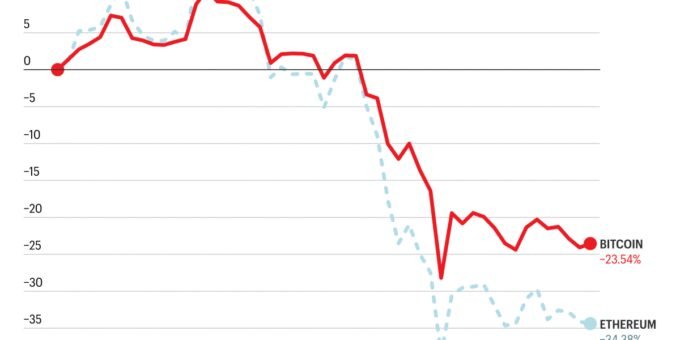

Bitcoin and Ether: A Muted Response

While Bitcoin and Ether prices also saw declines during this period, their liquidation figures were notably lower than those tied to metals-linked products. This suggests that the broader “risk-off” sentiment affected the entire market, but the specific, concentrated unwinding of highly leveraged positions was predominantly in tokenized commodities.

As markets continue to grapple with volatility, the question remains: will tokenized commodities maintain their newfound prominence, or will the crypto world’s attention revert to its core digital assets? This recent event undeniably marks a significant chapter in the evolving narrative of crypto as a sophisticated, multi-faceted financial ecosystem.

For more details, visit our website.

Source: Link

Leave a comment