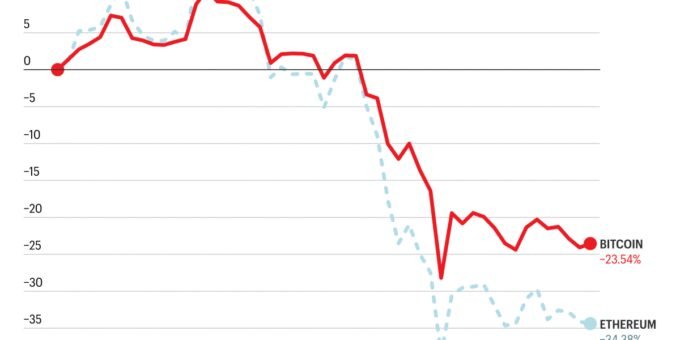

The cryptocurrency world was rocked on October 10th by what has been dubbed its “worst-ever liquidation day,” a seismic event that saw over $100 billion in Bitcoin derivatives open interest wiped out. Amidst swirling speculation and accusations of exchange failures, industry giant Binance has released a comprehensive report, firmly pinning the blame on a confluence of macroeconomic “risk-off” shocks, cascading liquidations, and critically thin liquidity, rather than any fundamental breakdown in its core trading systems.

Unpacking the October 10th Crypto Meltdown

Binance’s deep dive into the flash crash paints a picture of a market primed for a fall. For months leading up to October, Bitcoin and Ethereum had enjoyed a sustained rally, fostering an environment of heavy leverage among traders. This speculative positioning, coupled with an unprecedented $100 billion in Bitcoin derivatives open interest, created a highly volatile landscape.

According to the exchange, the initial trigger was a broad macro-driven selloff, exacerbated by global trade-war headlines that sent tremors through traditional markets. As prices began to slide, automated risk controls kicked in across the ecosystem, prompting market makers to drastically reduce exposure. This swift withdrawal of liquidity from order books, evidenced by Kaiko data showing bid-side depth vanishing on major exchanges, meant that even minor liquidations could trigger disproportionately sharp price drops, creating a self-feeding spiral of deleveraging.

A Global Contagion and Fragmented Markets

Crucially, Binance emphasizes that the disruption was not confined to the crypto sphere. The same day saw U.S. equity markets shed an estimated $1.5 trillion, with the S&P 500 and Nasdaq experiencing their largest single-day declines in six months. Binance estimates approximately $150 billion in systemic liquidations occurred across global markets, underscoring the broader macro shock at play.

Adding to the chaos was significant blockchain congestion. Ethereum gas fees soared above 100 gwei at times, severely slowing transaction speeds and hindering arbitrage opportunities between different trading venues. This inability to quickly move capital led to widening price gaps and further fragmentation of liquidity, intensifying the market’s vulnerability.

Binance’s Acknowledged Glitches and Proactive Compensation

While steadfastly attributing the primary cause to external macro factors, Binance did acknowledge two platform-specific incidents that occurred during the tumultuous period. However, the exchange maintains these issues were secondary and did not instigate the broader market collapse.

Internal Asset Transfer Slowdown:

Between 21:18 and 21:51 UTC, Binance experienced a slowdown in its internal asset-transfer system, impacting transfers between spot, earn, and futures accounts. This led to some users temporarily seeing zero balances due to backend timeouts. Binance clarified that core trading systems remained operational and attributed the issue to a database performance regression under surge traffic. The problem has since been resolved, and affected users were compensated.

Temporary Index Deviations:

A second incident involved temporary index deviations for USDe, WBETH, and BNSOL, occurring between 21:36 and 22:15 UTC. Significantly, Binance states that about 75% of the day’s liquidations had already taken place before these deviations. The exchange attributed this to thin liquidity and delayed cross-venue rebalancing disproportionately affecting index calculations. Methodology changes have been implemented, and impacted users received compensation.

In a move to stabilize its user base and mitigate losses, Binance confirmed it compensated users with over $328 million and launched additional support programs. This proactive approach, coupled with the detailed report, aims to provide transparency and reinforce confidence in the platform’s resilience.

The October 10th event serves as a stark reminder of the interconnectedness of global financial markets and the inherent volatility within the highly leveraged cryptocurrency space. Binance’s report offers a crucial perspective, shifting the narrative from internal failure to a broader, macro-driven market correction, while also demonstrating accountability for its own operational hiccups.

For more details, visit our website.

Source: Link

Leave a comment