Bitcoin’s Uncharacteristic Stagnation Amidst Dollar Weakness

In a surprising turn of events, Bitcoin, often touted as a digital safe haven and a hedge against traditional currency fluctuations, has failed to capitalize on the recent slide in the U.S. dollar. While gold and other hard assets have surged, the world’s leading cryptocurrency has remained largely range-bound, prompting analysts to delve into the underlying dynamics of this unusual divergence.

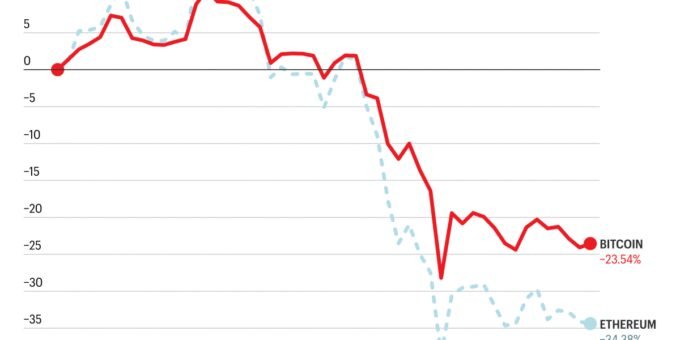

Historically, a weakening dollar has often provided tailwinds for Bitcoin, with investors seeking alternative stores of value. However, the current scenario paints a different picture, as the Dollar Index (DXY) has shed 10% over the past year, yet Bitcoin has paradoxically lost 13% in the same period, according to CoinDesk data. The broader CoinDesk 20 index, tracking major digital assets, fared even worse, declining by 28%.

JPMorgan’s Insight: Short-Term Flows vs. Macro Shifts

Investment banking giant JPMorgan offers a compelling explanation for Bitcoin’s subdued performance. According to their strategists, the dollar’s current weakness is not indicative of a fundamental, lasting macro shift in global economic growth or monetary policy expectations. Instead, it’s primarily driven by short-term market flows and sentiment.

The Nuance of Dollar Depreciation

Yuxuan Tang, J.P. Morgan Private Bank’s head of macro strategy in Asia, emphasized this distinction. “It’s crucial to note that the recent dollar slide isn’t about shifts in growth or monetary policy expectations,” Tang stated in a note. “If anything, interest rate differentials have actually moved in the USD’s favor since the start of the year. What we’re seeing now, much like last April, is a USD selloff driven primarily by flows and sentiment.”

This perspective suggests that the dollar’s decline is perceived as temporary, a transient phase that will likely stabilize as the U.S. economy gathers momentum throughout the year. This expectation of a temporary dip, rather than a structural re-evaluation of the dollar, is key to understanding Bitcoin’s current behavior.

Bitcoin: Still a Risk Asset, Not a Dollar Hedge (For Now)

Because markets do not view the current dollar decline as a durable macro shift, Bitcoin continues to be treated predominantly as a liquidity-sensitive risk asset rather than a reliable dollar hedge or a default store-of-value. This stands in stark contrast to gold and emerging markets, which are currently benefiting more directly from dollar diversification strategies.

Without a clear and sustained shift in monetary policy expectations or a fundamental change in growth dynamics, the mere weakness of the dollar has proven insufficient to attract significant new capital into the crypto markets. Investors seeking genuine dollar diversification are, for now, looking towards more traditional avenues.

The Path to a True Hedge Status

J.P. Morgan Private Bank’s framework suggests that until growth or interest rate dynamics supersede short-term flows and sentiment as the primary drivers of currency markets, Bitcoin may continue to lag behind established macro hedges. For the largest cryptocurrency to truly act as a counter-cyclical asset against dollar weakness, a more profound and lasting shift in global economic fundamentals would likely be required.

Until then, Bitcoin’s journey remains intertwined with its perception as a risk asset, navigating market liquidity rather than consistently serving as a direct beneficiary of a softer greenback.

For more details, visit our website.

Source: Link

Leave a comment