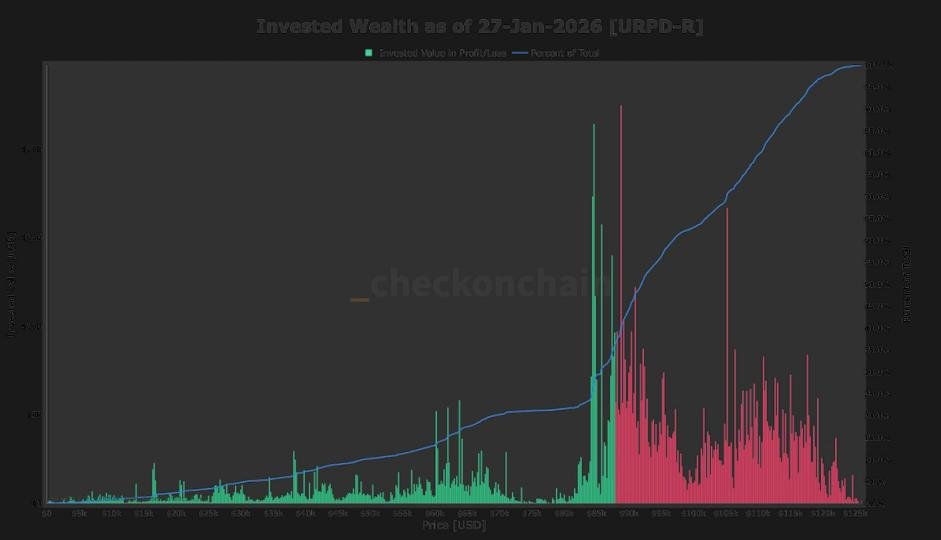

In a significant turn for the cryptocurrency market, more than half of all Bitcoin (BTC) investors are currently finding themselves in a precarious position, with their initial investment cost basis exceeding the current market price. Data from Checkonchain reveals a stark reality: approximately 63% of the total invested Bitcoin wealth was acquired at a price point above $88,000, placing a substantial portion of the market “underwater” as the asset struggles to maintain this critical level.

The $88,000 Threshold: A Deep Dive into Investor Holdings

The concept of “invested wealth” in Bitcoin refers to the total value of capital deployed when coins last moved on-chain. This differs from the “cost basis,” which is the average price at which a specific amount of Bitcoin was acquired. The latest on-chain analysis indicates that the majority of capital flowed into Bitcoin when its price was significantly higher than today’s trading levels. This heavy concentration of supply above current prices creates a vulnerable market structure, susceptible to increased selling pressure if key support levels fail to hold.

Unpacking the UTXO Realized Price Distribution (URPD)

This crucial insight stems from the UTXO Realized Price Distribution (URPD) metric. URPD is a powerful on-chain indicator that visually represents the price levels at which the existing Bitcoin supply last transacted. Each bar on the URPD chart signifies the volume of Bitcoin whose most recent movement occurred within a specific price range. The current URPD data paints a clear picture: a heavy concentration of supply exists between $85,000 and $90,000, coupled with notably thin support below the $80,000 mark.

Navigating Critical Price Zones and Potential Downside

Bitcoin’s price has been largely confined to a range between $80,000 and $90,000 since November. The URPD highlights just how much capital is currently at a loss within this range, with tens of billions of dollars sitting between $85,000 and $90,000. A sustained price move below $85,000 could trigger a cascade of selling as investors, already underwater, attempt to mitigate further losses. Alarmingly, long-term holders, typically known for their resilience, are already offloading their holdings at the fastest rate seen in six months.

The $80,000 Support and the Path to $70,000

Adding to the market’s fragility is the relative scarcity of supply between $70,000 and $80,000. Should the critical $80,000 support level, last tested in November, give way, analysts suggest a rapid descent towards the $70,000 mark becomes a distinct possibility. This lack of robust buying interest in that intermediate zone could accelerate any downward momentum.

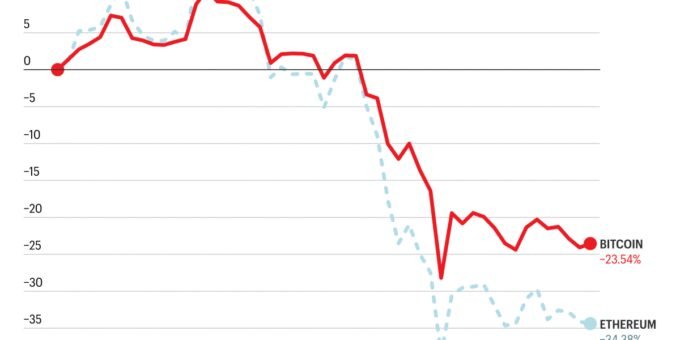

February’s Historical Promise vs. Present Challenges

As January concludes with little change in Bitcoin’s price, breaking a streak of three consecutive monthly declines without a significant relief rally, attention now shifts to February. Historically, February has been a strong month for Bitcoin, boasting average gains of around 13%, according to Coinglass data. However, whether history will repeat itself this year remains uncertain. The market’s ability to absorb the substantial overhang of “underwater” supply will likely dictate Bitcoin’s trajectory in the coming weeks. Investors will be closely watching for signs of capitulation or renewed buying interest to determine if the digital asset can reclaim its upward momentum or if further consolidation, or even decline, is on the horizon.

For more details, visit our website.

Source: Link

Leave a comment