Boeing Soars: Aerospace Giant Achieves Seven-Year Delivery High, Prepares for Accelerated Production

In a powerful testament to its ongoing recovery, Boeing is poised to announce its highest annual airplane deliveries since 2018. This significant milestone signals a clear turnaround for the aerospace behemoth, which has grappled with a series of safety crises and persistent quality challenges for years. With production stabilized, the manufacturer is now strategically gearing up to significantly ramp up its output.

“It’s a long road back from a … shall we say, a rather dysfunctional culture, but they’re making big progress,” remarked Richard Aboulafia, managing director at AeroDynamic Advisory, an influential aerospace industry consulting firm. His assessment underscores the substantial strides Boeing has made.

Navigating Turbulence: A Look Back at Boeing’s Challenges

The path to this resurgence has been fraught with difficulties. Boeing was compelled to drastically scale back production following two catastrophic crashes involving its flagship 737 Max aircraft in 2018 and 2019. Further compounding its woes, a mid-air door plug blowout on one of its planes in early 2024 intensified scrutiny. Beyond these safety incidents, the global Covid-19 pandemic severely disrupted airplane assembly for both Boeing and its primary competitor, Airbus, leading to pervasive supply chain delays and a critical loss of experienced personnel.

Leadership’s Steady Hand: Charting a Course for Growth

Under the stewardship of CEO Kelly Ortberg, a seasoned aerospace executive who emerged from retirement to lead the company post-door plug incident, Boeing is now firmly focused on increasing production. The immediate targets are its highly profitable 737 Max aircraft and the long-range 787 Dreamliners. This strategic acceleration is crucial for the manufacturer, which stands as the top U.S. exporter by value, to reclaim profitability – a status it hasn’t held for seven years as its leadership was primarily occupied with damage control and appeasing frustrated airline executives awaiting delayed deliveries.

The mood among stakeholders has shifted dramatically. Boeing’s enhanced predictability and increased production, crucially backed by the Federal Aviation Administration (FAA), have fostered renewed confidence. A significant indicator of the FAA’s trust came in September, when the agency reinstated Boeing’s authority to issue its own airworthiness certificates for some 737s and 787s prior to customer handover – a privilege restricted for years.

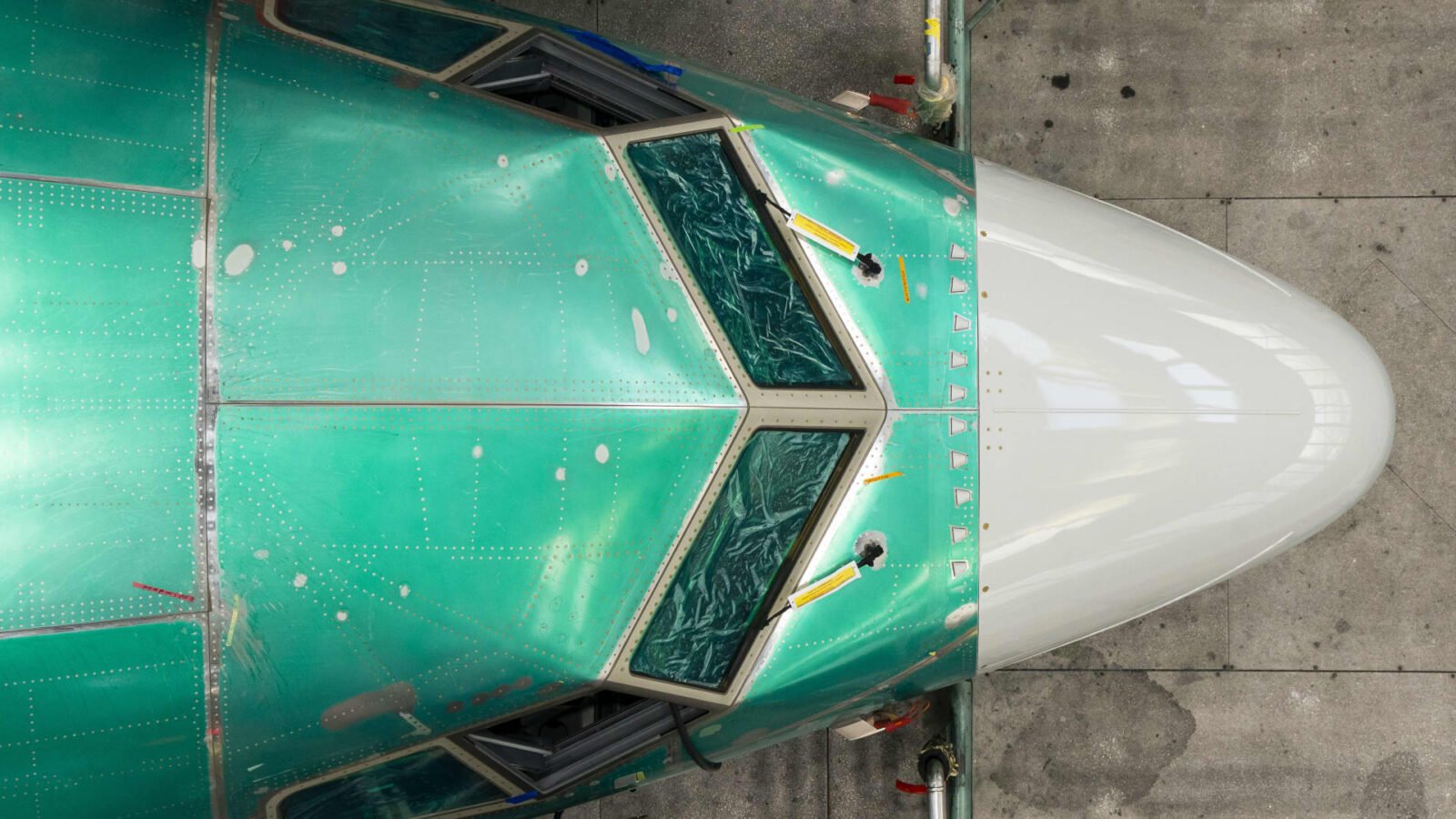

Operational Excellence: Rebuilding from the Assembly Floor Up

The recent turnaround is largely attributable to fundamental improvements on the assembly floor. Ortberg’s tenure has seen a concerted effort to slash “traveled work” – the costly and error-prone practice of performing assembly tasks out of sequence. Complementary manufacturing changes, including enhanced training programs, have also been implemented. The National Transportation Safety Board (NTSB) had previously highlighted inadequate training and management oversight as contributing factors to the January 2024 door plug incident, underscoring the importance of these reforms.

Further bolstering its control over critical supply chains, Boeing completed the re-acquisition of fuselage maker Spirit AeroSystems on December 8. This move brings a crucial supplier back under direct corporate oversight, mitigating risks and streamlining production.

Accelerating Towards the Future: Production Targets and Outlook

Boeing delivered 537 aircraft in the first 11 months of last year. While official December figures are pending, Jefferies estimates an additional 61 commercial jets were delivered last month, including 44 of the best-selling 737 Max. This would place last year’s total significantly higher than the 348 aircraft delivered in 2024 and 528 in 2023, though still below the 806 handed over in 2018.

Optimism is palpable among investors, with Boeing shares climbing 36% over the past 12 months, outperforming the S&P 500. “Boeing is definitely better and more stable,” affirmed Bob Jordan, CEO of all-Boeing airline Southwest Airlines, in a December 10 interview.

The FAA, in October, raised its production cap on the 737 Max from 38 to 42 aircraft per month (a sign-off required post-door plug accident). CFO Jay Malave anticipates reaching this rate by early 2026, with Ortberg hinting at further incremental increases of five planes. Malave also indicated that 2026 handovers would primarily consist of new production, rather than clearing older inventory. Additionally, Boeing aims to produce approximately eight Dreamliners per month starting early this year.

Boeing’s commercial aircraft division remains its largest unit, contributing about 46% of sales in the first nine months of last year. The company is scheduled to unveil its detailed production plans for 2026 later this month, coinciding with its quarterly results report on January 27. The aerospace giant appears to be firmly on a trajectory of recovery and growth.

For more details, visit our website.

Source: Link