XRP’s Resurgent Rally: A Deep Dive Beyond $2

The digital asset XRP, closely associated with Ripple, has once again captured the market‘s attention, surging decisively past the crucial $2.00 mark. This significant move has ignited a fresh wave of speculation and analysis among traders, who are now keenly observing whether this breakout can sustain its momentum or if it signals another volatile swing.

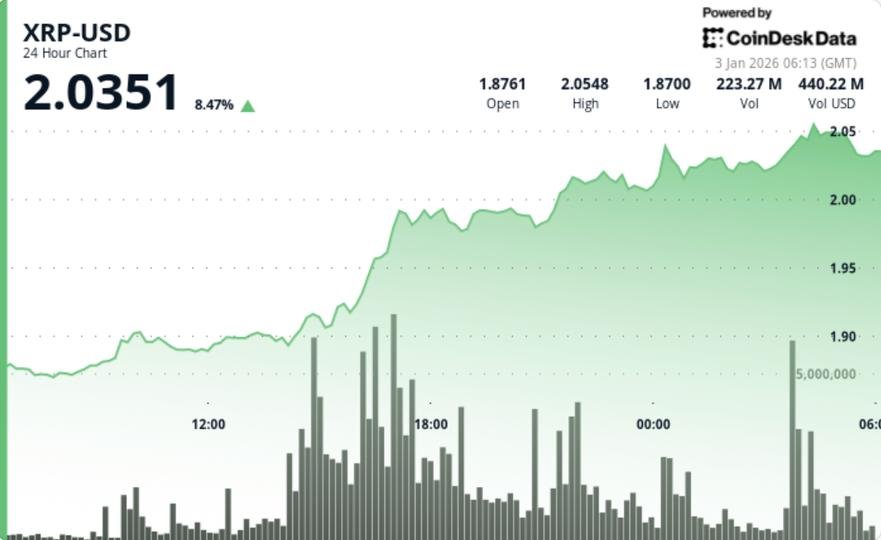

On January 3, 2026, XRP witnessed an impressive 8.7% jump, climbing from $1.8766 to $2.0227 within a 24-hour session. This rally was not merely a fleeting spike; it was characterized by a robust surge in volume, particularly at 17:00 UTC, when trading volume soared to 154.4 million – a staggering 142% above the session average. This substantial volume suggests the involvement of larger market participants, lending credibility to the breakout.

Navigating the Technical Landscape: Key Levels to Watch

The Pivotal $1.96 Flip

The immediate catalyst for XRP’s ascent was its clean break through the $1.96 resistance level. Historically, $1.96 has acted as a recurring decision point, often rejecting rallies or attracting swift selling upon failure. This time, however, buyers forced a decisive breach, effectively flipping this key ceiling into a new support level. The ability of XRP to maintain above this level is paramount for any sustained upward trajectory.

Establishing New Support: The $2.01-$2.03 Zone

Following the breach of $1.96, XRP pushed into the $2.00–$2.03 band, establishing a new support pocket near $2.01–$2.03. This zone is now being treated by traders as the ‘must-hold’ area for the breakout to stick. A crucial test occurred late in the session when XRP pulled back modestly from a high of $2.031 to approximately $2.023. This controlled retracement, a mere ~0.4% dip with 1.59 million in volume, is precisely what traders look for after a breakout – a period of digestion rather than immediate rejection, indicating underlying strength.

What’s Next for Traders: Holding the Flip

The current market dynamic shifts focus from chasing the initial breakout to diligently observing whether XRP can ‘hold the flip’ – meaning, maintaining the newly established support levels. The path forward for XRP will be dictated by its interaction with these critical price points:

Bullish Scenario: Sustained Momentum

- If XRP successfully holds the $2.01–$2.03 zone and keeps the psychological $2.00 level intact, the breakout remains valid.

- Under this scenario, the market can begin to target $2.03–$2.05 initially, followed by the next resistance pocket above that.

- Sustained trade above recent consolidation highs would strongly signal that buyers remain in control, potentially triggering a second leg higher.

Bearish Scenario: Risk of Retracement

- Should XRP lose the $2.00 handle and slip under $2.01, the breakout risks being categorized as a ‘breakout without follow-through.’

- This would likely lead to a retest of the $1.96 level, which now serves as the critical line between a bullish reset and a return to the prior trading range.

- If $1.96 fails on the retest, the rally could be treated as a liquidity event, reopening the downside and potentially sending XRP back toward its pre-break base.

The Bottom Line

While $2.00 is the headline-grabbing psychological level, the true ‘line in the sand’ for XRP’s immediate future is $1.96. If bulls can successfully defend both these levels, the digital asset has a strong foundation to build a continuation move. However, a failure to hold these critical supports could see XRP slide back into the familiar range it has just fought to escape, leaving traders to reassess its short-term prospects.

For more details, visit our website.

Source: Link