XRP’s Paradox: Supply Squeeze Meets Stubborn $2 Resistance as Exchange Balances Hit 8-Year Low

In the volatile world of cryptocurrency, XRP finds itself at a fascinating crossroads. Despite a significant bounce to $1.87 and a dramatic reduction in exchange supply—hitting an eight-year low—the digital asset continues to grapple with a formidable psychological and technical barrier at the $2 mark. This dynamic sets the stage for a compelling tug-of-war between tightening market fundamentals and entrenched selling pressure.

The Great Exodus: XRP’s Supply Squeeze Intensifies

The most striking development for XRP comes from its supply metrics. Data reveals that the amount of XRP held on exchanges has plummeted to roughly 1.6 billion tokens, a staggering 57% decrease since October. This isn’t just a minor fluctuation; it marks the lowest exchange-held supply since 2018, signaling a profound shift in holder behavior. The prevailing narrative suggests that a substantial portion of XRP is being moved off trading platforms and into longer-term storage or secure custody solutions. This ‘supply squeeze’ scenario, where fewer tokens are readily available for sale, historically has the potential to amplify price movements when demand eventually picks up.

This trend aligns with a broader institutional pivot towards more structured and regulated investment avenues, even as spot markets remain characterized by choppiness. For XRP, this means a supportive long-term bid is forming beneath the surface, even if short-term momentum appears fragile.

The $2.00 Hurdle: A Battleground for Bulls and Bears

While the supply narrative paints a bullish long-term picture, XRP’s immediate challenge lies squarely at the $1.88 to $2.00 resistance band. Repeated attempts to breach this zone have been met with strong selling pressure, turning it into a significant supply zone where sellers are comfortable offloading their holdings on rallies. The psychological $2.00 handle, in particular, has proven to be a stubborn ceiling, consistently capping upward movements.

Technical Snapshot: A Controlled Recovery

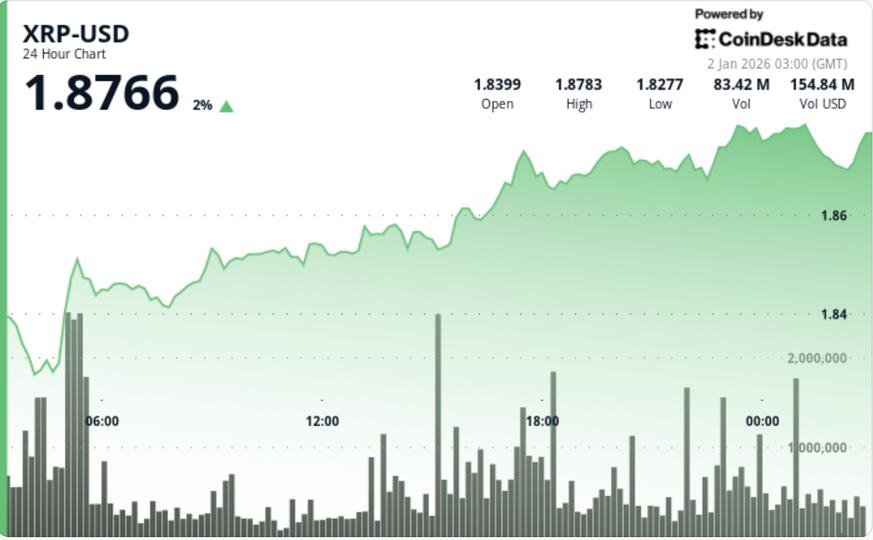

XRP’s recent climb from $1.84 to $1.87, representing a modest 1.7% gain, saw the asset print higher lows and maintain a relatively contained intraday volatility of about 2.5%. Crucially, this upward push was accompanied by an expansion in trading volume, peaking around 32 million—approximately 50% above average. This suggests that the move wasn’t merely a drift on thin liquidity but rather a more concerted effort from buyers.

However, the ‘tape’ still reads like a controlled recovery rather than a decisive breakout. The price repeatedly stalled as it approached the $1.88 area, reinforcing its significance as a resistance point. Momentum indicators present a mixed bag; while some oscillators show bullish divergence (improving momentum despite price not fully breaking out), a sustained push above resistance is needed to validate these signals. On the downside, the structure remains constructive as long as XRP holds above the $1.82–$1.83 base established during early session tests, and more broadly, above the $1.77 floor, which represents the next clear demand pocket.

What’s Next? Navigating the Inflection Point

The current market for XRP is a delicate balance between compelling long-term fundamentals and immediate technical hurdles. Traders are advised to watch key levels closely:

Bull Case: Breaking the Ceiling

A sustained push above $1.88 would open the door for a run towards $1.95, with the psychological $2.00 mark acting as the ultimate breakout trigger. A decisive reclaim of $2.00 would likely attract momentum buyers and force a repositioning from sellers who have been defending this zone, potentially paving the way for further upside.

Bear Case: Retreating to Demand

Conversely, a failure to hold the $1.82–$1.83 base would shift focus back to $1.77, which serves as the next meaningful demand pocket. Should this level break, the risk extends lower into broader support regions where buyers have historically re-emerged. The immediate battlefield, however, remains clearly defined between $1.77 and $1.88.

For now, the shrinking exchange supply continues to build a constructive longer-term setup for XRP. Yet, the market awaits a decisive victory above the $1.88–$2.00 resistance band before the bullish narrative can truly take control.

For more details, visit our website.

Source: Link