Dogecoin Roars Back: Analyzing the Double-Bottom Breakout Fueling DOGE’s Rally

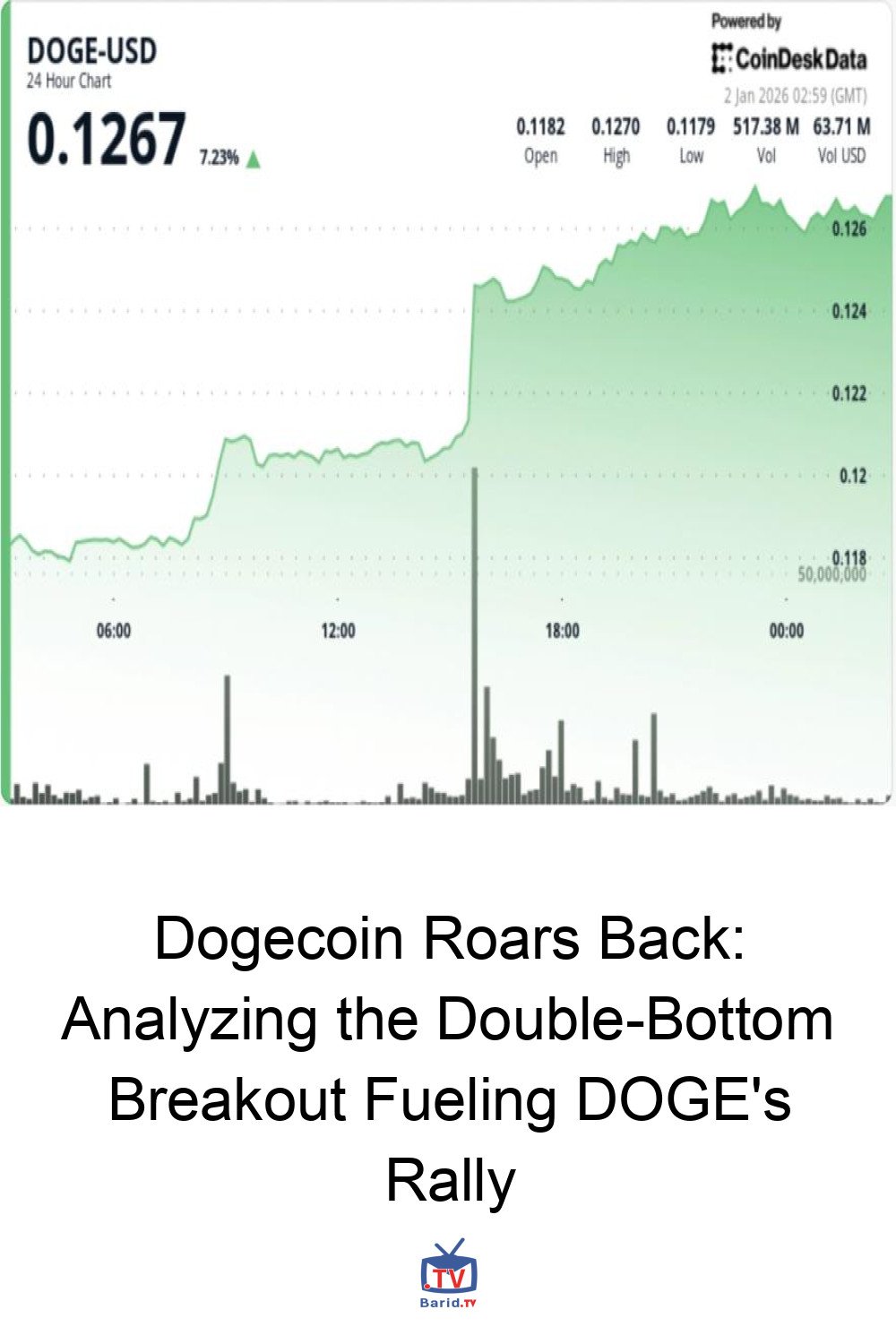

In a significant move that has captured the attention of the cryptocurrency market, Dogecoin (DOGE) has staged an impressive rally, surging over 7% as it decisively broke past a critical resistance level. This breakout, underpinned by robust spot market activity, signals a potentially healthier and more sustainable upward trajectory for the popular meme coin, shifting market focus to its ability to consolidate gains and target higher price zones.

The Catalyst: A Powerful, Volume-Led Breakout

Dogecoin’s price climbed to $0.126, successfully breaching the formidable $0.121 resistance band that had previously capped multiple recovery attempts. What makes this move particularly noteworthy is the sheer volume accompanying it. Trading activity soared to 1.23 billion tokens, a staggering 183% above the daily average, with the primary impulse occurring on January 1st. This volume-led ascent, driven by genuine spot market participation rather than purely derivatives-driven spikes, lends significant credibility to the rally, suggesting a broad-based buying interest.

This strong performance comes as meme tokens, often considered a barometer for the ‘risk-on’ appetite in crypto, attempt to find stability after a challenging December. That month saw liquidity thin out and spot markets become highly reactive to concentrated bursts of flow, leading to more “all at once” breakouts rather than gradual trend-building. DOGE’s current rally, supported by spot activity, aligns with a cleaner breakout profile, indicating reduced leverage and a more organic market move.

Decoding the Technicals: The Double-Bottom Pattern

From a technical analysis perspective, the structure of this rally is as important as the percentage gain itself. DOGE appears to have successfully completed a “double-bottom” style base formation around the $0.120–$0.121 region. The decisive break above this band transforms what was once a strong resistance into a potential retest zone, a classic bullish reversal signal.

Furthermore, the rally established a clear sequence of higher lows into the close, transitioning into a period of consolidation rather than an immediate reversal. This behavior, characterized by reduced volatility and declining volume in the immediate aftermath of the spike, suggests that selling pressure did not immediately overwhelm buyers, further reinforcing the health of the breakout.

What’s Next for DOGE? Key Levels to Watch

For traders and investors, the current scenario presents a crucial “breakout-and-hold” setup. The immediate question is not whether DOGE can rally—it already has—but whether buyers can successfully defend the newly reclaimed levels. The key price points to monitor are straightforward:

- Maintaining Support: If Dogecoin can firmly hold above the $0.1245–$0.125 range, it opens the door for a sustained grind towards the next significant supply zone at $0.132–$0.134. This area aligns with a critical resistance cluster and the “neckline-type” target often pursued after a double-bottom breakout. A clean push through $0.132 could swiftly propel the price towards $0.136.

- Risk of Reversal: Conversely, a failure to hold the $0.1245 level would risk turning this breakout into a failed move. In such a scenario, the price would likely retreat back into its prior base around $0.121. This level would then become the crucial “make or break” retest.

- Downside Scenario: Should $0.121 fail on a retest, the rally might be reclassified as merely a relief move, reopening downside risk towards the $0.118–$0.109 range.

The Bottom Line

Dogecoin’s recent surge, driven by strong spot volume and a clear technical breakout from a double-bottom pattern, marks a significant moment for the meme coin. The breakout has done its job; now, the market will scrutinize whether DOGE can consolidate its gains above $0.1245. If it does, higher targets at $0.132–$0.136 appear within reach. If not, this could quickly revert to a classic failed breakout, sending the price back into its previous range. All eyes are now on DOGE’s ability to defend its newfound territory.

For more details, visit our website.

Source: Link