Standard Chartered Reignites Bullish XRP Forecasts

The cryptocurrency market is once again abuzz with a bold prediction for XRP, as Standard Chartered reiterates its highly optimistic forecast: an $8 valuation for the digital asset by the close of 2026. This projection implies a staggering 300% surge from current levels, fueled by a confluence of improving regulatory clarity in the United States and burgeoning institutional interest.

Initially outlined in an April note, this bullish outlook is gaining renewed traction, positioning XRP as a significant contender in the evolving digital asset landscape. Geoff Kendrick, Standard Chartered’s global head of digital assets research, highlights that the easing of legal uncertainties has paved the way for greater institutional exposure and allowed Ripple, the company behind XRP, to innovate without the constant shadow of litigation.

Institutional Inflows and Supply Dynamics

Evidence of this institutional embrace is already manifesting. U.S.-listed spot XRP Exchange Traded Funds (ETFs) have reportedly attracted approximately $1.25 billion in net inflows since their November launch. This steady accumulation contrasts with the more erratic flow patterns observed in Bitcoin and Ethereum ETFs, suggesting a more consistent, long-term allocation strategy for XRP.

Compounding this demand-side narrative, XRP exchange balances have plummeted to multi-year lows. This reduction in liquid supply on trading venues, while not a guaranteed precursor to price appreciation, can significantly amplify upward movements should demand remain robust and sellers become less inclined to part with their holdings.

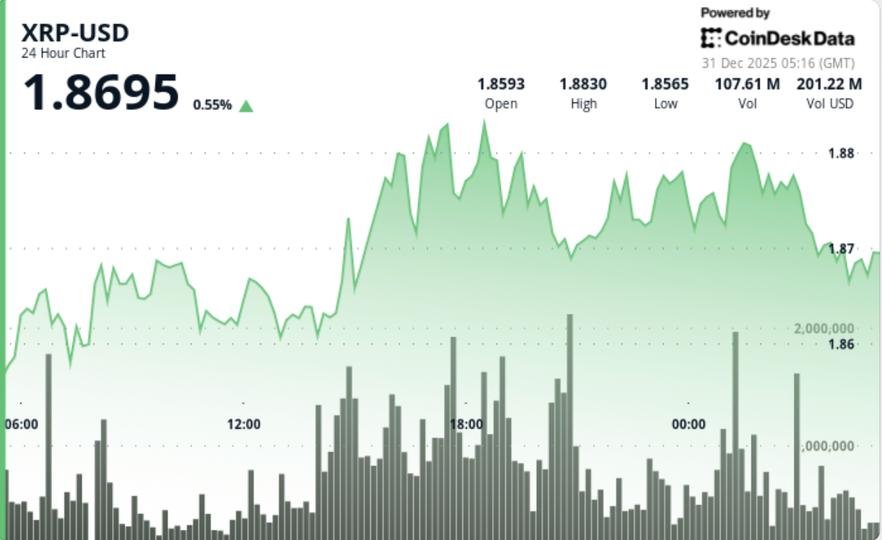

Current Market Dynamics: A Tense Standoff

Despite the optimistic long-term outlook, XRP’s immediate price action paints a picture of cautious positioning. The token recently edged lower to $1.87, clinging to a narrow range around the critical $1.85 support zone, even as trading activity surged by approximately 20.8% above weekly norms. This peculiar combination of elevated volume and muted price movement often signals market participants are accumulating or distributing positions ahead of a significant move, rather than reacting to immediate panic.

Technical Indicators Signal Caution

From a technical perspective, the landscape remains challenging. XRP’s failure to extend above $1.8792, particularly during a peak trading window that saw 57.2 million units exchanged, underscores persistent selling pressure. Sellers appear to be actively leaning into rallies, preventing the price from reclaiming higher ranges.

The $1.85 level stands as a pivotal line in the sand. While it has held firm against recent tests, the broader market structure remains heavy. Moving averages are stacked bearishly and continue to slope downwards, effectively capping upside attempts and maintaining a bias towards selling into strength.

Derivatives Market: Leverage Builds Amid Uncertainty

Adding another layer of complexity, derivatives signals indicate a build-up of leverage. Open interest climbed to $3.43 billion, yet spot netflows registered a negative $10.7 million. This divergence suggests that traders are increasing their leveraged positions without a corresponding aggressive demand in the spot market. Such a scenario can tighten trading ranges but also heightens the risk of sharp, volatile price movements if the market is forced to unwind quickly.

Upcoming Catalyst: The January Escrow Unlock

A significant near-term catalyst looms on the horizon: January’s scheduled unlock of 1 billion XRP from escrow. While a substantial portion is typically re-escrowed, this event historically amplifies sensitivity to supply and liquidity dynamics, especially when the price is already hovering around a major technical support level. It could be the trigger for the anticipated sharp movement.

Navigating the Path Ahead: Key Levels for Traders

The current market is characterized by a defense of support levels against overhead supply. Traders should closely monitor the following:

- Upside Scenario: If the $1.85 support holds and XRP can reclaim the $1.88–$1.89 zone, the next key test lies at $1.92–$1.93, where sellers have repeatedly intervened. A decisive close above this area would signal a short-term shift towards recovery, potentially opening the path to $2.00 and the downtrend line near $2.08.

- Downside Scenario: A decisive break below $1.85 would likely see the market rotate into the next demand pocket around $1.77, with deeper support levels coming into focus near $1.60–$1.55.

In the immediate term, the combination of rising volume and muted price action suggests strategic positioning ahead of the January escrow unlock rather than a clear directional trend. However, the compression around the $1.85 mark indicates that the eventual breakout is more likely to be sharp and impactful than gradual.

For more details, visit our website.

Source: Link