Bitcoin’s Bullish Turn: Long-Term Holders Pivot to Accumulation, Easing Market Pressures

After a period of intense selling pressure, Bitcoin’s long-term holders (LTHs) have made a decisive pivot, returning to net accumulation for the first time since July. This crucial shift signals a potential easing of a major headwind that has challenged the cryptocurrency market throughout recent corrections, offering a renewed sense of optimism for investors.

A Historic Shift in Holder Behavior

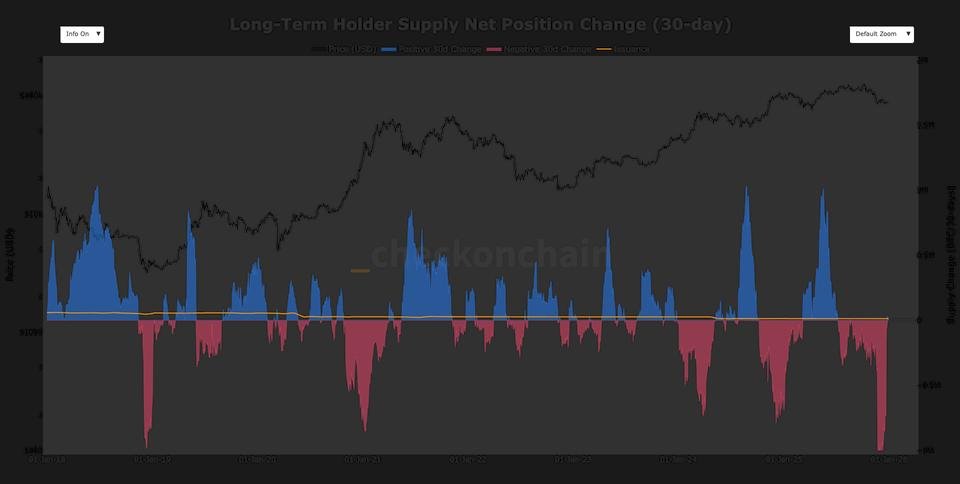

Long-term holders, defined as entities that have held Bitcoin for at least 155 days, are often seen as the backbone of the market, representing conviction and stability. Data from on-chain analysts checkonchain reveals that LTHs have accumulated approximately 33,000 BTC on a 30-day net basis. This positive change marks a significant reversal from previous trends, indicating that recent buyers are maturing into steadfast holders, outstripping the pace of distribution.

The Shadow of Past Distribution

The journey to this accumulation phase has been marked by substantial distribution from LTHs. During the current correction, this cohort offloaded over 1 million BTC, representing the largest sell-pressure event from long-term holders since 2019. This extensive selling was one of two primary sources of market pressure this year, alongside miner capitulation, where miners are often forced to sell to cover operational costs.

Three Waves of LTH Selling

This cycle witnessed three distinct waves of LTH distribution. The first occurred in March 2024, coinciding with Bitcoin reaching $73,000, where over 700,000 BTC were sold. A second major distribution followed in November when Bitcoin touched $100,000, seeing more than 750,000 BTC distributed. The most recent and largest sell-off, exceeding 1 million BTC, transpired during the 36% correction from October—a period reminiscent of the 2019 bear market low when Bitcoin traded around $3,200.

What This Accumulation Means for Bitcoin’s Future

The transition of short-term holders into long-term holders—a process that typically takes 155 days—is now evidently outpacing the remaining distribution. This suggests a growing conviction among investors who entered the market in the past six months, choosing to hold rather than sell despite market volatility. The return to accumulation by LTHs is often interpreted as a bullish signal, indicating a strengthening of the asset’s underlying holder base and a potential reduction in future selling pressure.

As a significant headwind recedes, the market may find more stable ground. This shift could pave the way for renewed upward momentum, as the supply held by those least likely to sell continues to grow. For investors, this development offers a glimmer of optimism, reinforcing the narrative of Bitcoin’s long-term resilience and its capacity to attract and retain dedicated holders even through challenging periods.

For more details, visit our website.

Source: Link