Galaxy Digital’s Head of Research on Bitcoin’s Uncertain Outlook in 2026

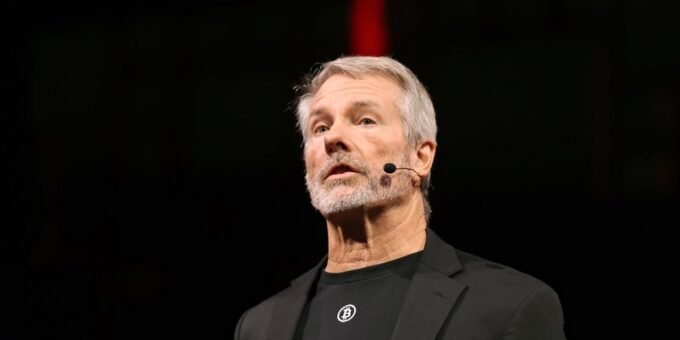

Galaxy Digital’s Alex Thorn says options markets, falling volatility, and macro risks make next year hard to forecast even as the firm keeps a bullish long-term view.

Why Bitcoin’s Outlook is So Uncertain in 2026

Galaxy Research, the research arm of Galaxy Digital, says overlapping macroeconomic and market risks make bitcoin unusually difficult to forecast in 2026.

The firm says that options pricing and volatility trends indicate that bitcoin is maturing into a more macro-like asset, rather than a high-growth trade.

Galaxy Digital’s Long-Term Outlook for Bitcoin

Galaxy maintains a long-term bullish outlook, projecting that bitcoin could reach $250,000 by the end of 2027.

Thorn believes that expanding institutional access, potential easing of monetary conditions, and demand for alternatives to fiat currencies could position bitcoin to follow gold’s path as a hedge against monetary debasement.

Why a Quiet Year May Not Matter

For Thorn, those signals help explain why a potentially range-bound or “boring” 2026 would not undermine bitcoin’s longer-term case.

Even if prices drift lower or approach long-term technical levels such as the 200-week moving average, he expects institutional adoption and market maturation to continue.

Galaxy’s 2026 Predictions for Crypto Markets

In its Dec. 18 report, the firm stated that a major asset-allocation platform could incorporate bitcoin into standard model portfolios, a move that would embed the asset into default investment strategies rather than through discretionary trades.

Such inclusion would direct persistent flows into bitcoin regardless of market cycles, reinforcing Galaxy’s view that structural adoption — rather than near-term volatility — will shape outcomes into 2027 and beyond.

Source: Link